Trump 2.0: Infrastructure Investment, Traditional Energy Resurgence, and Foreign Capital

Exploring the Interplay of Infrastructure Investment, Energy Policies, and Foreign Capital in Shaping America's (AI) Economic Future

I started covering AI by examining the energy and power demand it will need for its infrastructure build-out, which includes the data centers, water cooling systems, connectivity equipment, and much more.

Some relevant pieces:

AI Arms Race Far From Over: Chips is Only Half the Game, Infrastructure is the Other

Johor, Malaysia: AI Data Centers Drive Investment But Infrastructure Challenges Persists

Today, we will go back to where we started with this newsletter. We take a closer look at data centers and energy consumption/ shortage and how Trump 2.0 will shake things up (for better or worse).

In the evolving economic landscape, infrastructure has emerged as a key asset class, garnering increased attention from investors seeking stable returns amid rising inflation. This surge in interest has become more prevalent over the last decade, but some projects/ deals have been met with regulatory challenges over the years. As we see the return of Donald Trump to the U.S. presidency, we look at how his energy policies are poised to revive traditional energy sources and bolster fossil fuel production. As part of this shift, significant foreign investments are flowing into the U.S., particularly along the AI value chain, with some in data centers and technology sectors, exemplified by a landmark $20 billion commitment from Emirati billionaire Hussain Sajwani.

This article is a bit of a mish-mash of topics, but I try to tie it together by exploring how these interconnected trends are reshaping the future of the U.S. economy. It examines the implications of the trends in infrastructure investment, the energy mix, and foreign investment strategies in a rapidly changing political-economic relationship.

The Rise of the $1 Trillion Asset Class: Infrastructure Investment

Infrastructure has always been something private equity firms and public market investors looked at. Traditionally, infrastructure was grouped mainly into 1) utilities, 2) transportation, and 3) energy. Think about electricity grids, roads, bridges, and small nuclear reactor plants. However, as society has evolved and AI development has boosted data center demands, infrastructure investment for many investors has expanded into looking at fixed assets that would affect digital infrastructure.

Infrastructure has expanded beyond transportation or utilities. It now includes services critical to society's functioning, such as social welfare—healthcare and education—and digital facilities—optics, cloud computing, and data storage—making it a $1 trillion market. With the boom of capital injection across the value chain of artificial intelligence, this asset class has recently attracted billions in capital from major investment institutions such as BlackRock, Softbank, KKR and hyperscalers like Microsoft, Amazon, and Meta.

New-ish Asset Class: AI Infrastructure

With the boom of AI data centers, we see that “infrastructure” as an asset class evolving and becoming increasingly “sexy. ” I spoke to two investor friends who work at PE and mutual funds (one European and one Canadian) and mainly invest in private real estate deals. It was interesting to hear that their mandates have recently expanded to include data centers, which have become the most significant proportion of where their capital is being deployed currently. On the other hand, investors who traditionally covered the energy transition sector are also looking at how increasing AI demand will impact various energy sources. Hardware investors who traditionally looked at semiconductors sometimes also had a remit over connectivity technologies, and they are all being affected, too. As many traditional sectors are being impacted along the AI value chain, people are realizing that organically, a new asset class is being created - “AI infrastructure.”

In a report, the consulting firm McKinsey predicts that the U.S. data center demand will grow by at least ~4x to ~80-100 GW by 2030. And according to McKinsey's estimates, global data center demand will increase to at least 170 GW by 2030 at a 19% CABR. The speed and scale of investment in data centers have been staggering. And the cost is high. Building data centers will cost $900 billion over the next ten years, based on a report by Latitude Media, a digital media company focused on the energy transition, with others even forecasting that scaling AI and cloud infrastructure would cost $1 trillion by 2030 in the U.S.

Pankaj Sachdeva, a senior partner at Mckinsey, told Latitude Media that investors from all backgrounds are finding a way to get into data centers and AI infrastructure-related deals. “Whether you are a real estate investor, an infrastructure investor, a credit fund, or a private equity investor, you’re looking at data centers as an asset class and asking whether you should be investing in it,” Sachdeva told Latitude Media. “Even some of the investors that were not that interested [two years ago] are now starting to look at it from an opportunity standpoint.”

Energy Investments, Energy Bottlenecks

However, not all energy transition-related deals are for AI data centers. I’ve written about why renewable energy has not become a reliable and stable way to power data centers here and why the U.S. and global hyperscalers are trying to use nuclear energy despite safety concerns.

The key change factor is that the era of flat power demand increase has ended in the U.S. The country now faces an energy shortage, and Trump is ensuring that the issue is addressed (under the criticism of choosing brown energy sources over green). For many of the big tech, the core challenge impeding the deployment of data center capacity lies within power availability, special permits for site selection, long lead time for power equipment, and the shortage of specialized labor (which I’ve written about here.)

So, how are US hyperscalers navigating the challenges mentioned above?

Some hyperscalers are looking for alternative locations or systems that can provide the energy they need without the restrictions they face in their original markets. By moving to these secondary markets, they can access reliable power sources and better infrastructure to support their operations. [i.e., Indiana, Oklahoma for Google; Ohio, Iowa for Microsoft, Minnesota, Louisiana for Meta]

Hyperscalers are looking for new ways to obtain the power systems needed. Some are buying their own energy sources to avoid power shortages and using temporary power solutions until they can get regular electricity service. Significant money is also being invested to help them adopt these new energy sources and improve energy storage options. [i.e., switching to gas-powered generators, wind power, and so on]

Lastly, they're locking in renewable power contracts. [i.e., Microsoft’s $10 billion framework with Brookfield Renewable for 100% renewable mix]

Therefore, with Trump’s greenlight, McKinsey predicts that data center power demands will substantially increase (and supply will be met) in the next five years in the U.S., adding 450 Twh of new electricity demand at a CAGR of ~22%. This is not just led by AI but primarily by the usage of AI, data centers (some for AI), and manufacturing returning onshore (MAGA). Now, the context here is that power demand has not really increased in the US in the aggregate since 2007, and now, data centers make up about ~30% of the overall net new demand.

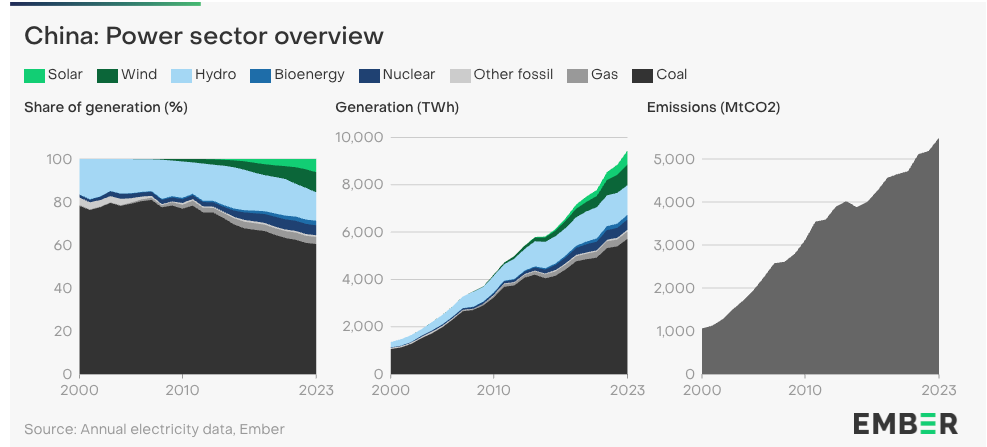

A bit of a tangent rant, this is very different from China’s case, where urbanization has led the country’s demand for electricity to grow steadily high single digital % for years, and due to the demand, the supply side has adjusted to keep up. Now, the surge in data center need for power is something the country can actually meet in supply easily, especially given its decade-long subsidy and policy pushing forward renewable options. For details on China’s Eastern Data, Western Computing policy, and energy policies that support AI infrastructure, see here. And to better understand the cloud infrastructure in the U.S. and China, see here.

Trump 2.0 is Open to Business

At this point, hyperscalers are willing to pay a 10-30% premium for faster access to power, according to Mckiney’s survey. Now, they’ve not had an easy time as hyperscalers were shut down by regulators when they tried to build new nuclear energy plants last year. And you can read about FERC’s NO to Amazon here.

However, the Trump administration’s pro-business stance could mean an OK-GO to YOLO for American data center operators & energy providers.

Microsoft has vowed an $80 billion investment in data centers for AI by the end of the fiscal year of 2025, with more than half of that injected into the U.S. market. As I wrote about here, Microsoft’s Vice Chair & President of Microsoft, Brad Smith, op-ed where the company practically pleaded with the incoming administration to give big tech the go-ahead to invest and build up AI infrastructure and develop AI. The tech executive strategically positions all these motives as a national interest and a fundamental American thing to do.

President Donald Trump has said that he will consider “declar(ing) a national energy emergency” as he orders to unleash domestic energy production and undo many of Biden’s renewable energy support and policies that were once designed to combat climate change. And just yesterday, Trump pulled out of the Paris Climate Accord once again.

During his inauguration speech, Trump lauded, “We will be a rich nation again, and it is that liquid gold under our feet that will help us do it.” He has not shied away from the fact that he will have a hard pivot on issues such as curbing fossil fuels and will open up the tanks on that front.

Some have said that Joe Biden is the least business-friendly president the U.S. has seen in decades. And in contrast, Trump is the extreme opposite, putting businesses first and foremost. The White House has said that his aim is to cut the red tape and regulations that have hindered free capital movement and consequently impacted Americans’ quality of life and access to parts of the economy.

Trump’s policies will take time to implement and come to life, but the weather wane is pointing to a business first and climate second future.

FDI into the U.S.

Just days ahead of his return to the White House, Trump announced a $20 billion deal to build new U.S. data centers, the caveat it’s led by Emirati billionaire Hussain Sajwan, founder and CEO of DAMAC Properties is a long-term business associate of Trump’s. This is only one of many foreign direct investments into the U.S. since Trump’s election victory.

In an interview with CNBC’s Dan Murphy, Sajwan was asked if he would eventually invest more in the U.S. to which he replied: “Well, I mean, the sky is the limit, we can invest more, as much as the market takes, then the limitation is not on.”

Sajwani seems to be enjoying his moment. The DAMAC Properties chairman went on Bloomberg’s podcast to talk about why they’re investing in the U.S. as well that day. He said that the company is seeing double-digit growth in data center growth and has invested in over 10 countries globally, the U.S. being one of them, the others in Asia and Europe (Malaysia, Indonesia, Greece, etc).

Adding that he’s been waiting for this moment for four years, that is, to invest in the U.S. when the foreign investment environment becomes more “friendly.”

At the end of his interview, he was asked if he had met Elon Musk and Sam Altman. He said he mumbled his words a little, saying something like, “I don’t (know) a Sam Altman,” but he confirmed that he met with Musk at Mar-a-Lago over New Year’s (I had a little chuckle here).

As the new administration has become so-called “friendlier” to FDI, foreign investment interest in the U.S. has increased. In December last year, the CEO of Japanese tech investment firm Softbank, Masayoshi Son, announced plans to invest $100 billion in the U.S. and create 100,000 jobs over the course of Trump’s four-year term.

[Jan 22 add: On Jan 21, the FT reported that OpenAI and SoftBank have jointly announced that they planned to launch a significant new US artificial intelligence infrastructure project, in a move Donald Trump lauded as a “declaration of confidence in America.”]

Will this be a trend in 2025? We’ll see. For all I know, given this crazy week of TikTok/ REDNOTE flip-flopping and chaos, that will likely not be CN $. And what about potential societal and environmental impacts? We’ll need to wait and see but it probably won’t be ideal.