China's 'Eastern Data and Western Computing': State Policies and Affordable Energy Solutions Push AI Infrastructure Ahead

China's AI infrastructure breakdown: cloud, computing power, data centers, renewable energy, favorable policies

I worked with The Economist Intelligence Unit (EIU)’s China analyst on a report on China’s cloud, data center, and AI investment wave (published Jan 8, 2025). The report can be accessed through a paid subscription to the EIU here.

Below, I’ve highlighted a few key points from the EIU piece and elaborated more. The article represents my views, and mine only, on China’s AI infrastructure build-out.

TL;DR

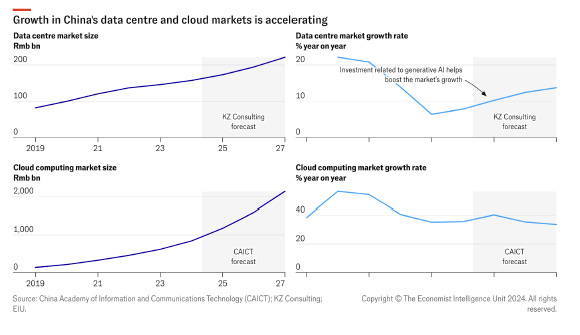

China’s data center and cloud market will likely continue growing in 2025- 2026. AI demand will largely drive this growth, which will boost the country’s fixed investment (power plants, data centers, cooling systems, infrastructure).

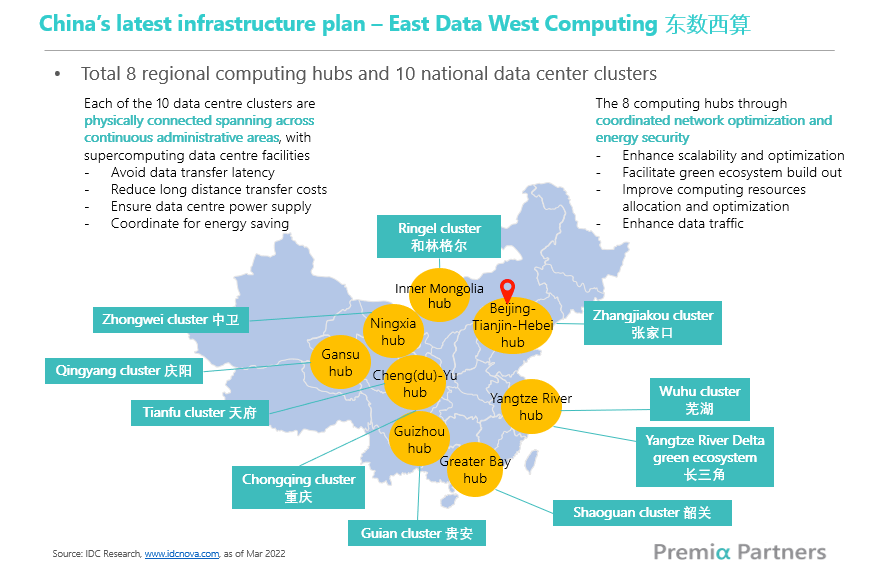

Government policies such as the “Eastern Data, Western Computing” (“东数西算”) initiative have effectively optimized regional resources.

The country’s top-down approach has faced some challenges but overall had a massive advantage in rallying public and private sectors together to get behind AI, much like it did with renewable energy a decade ago.

There have been signs of the excess buildout of data centers, similar to what happened with cloud infrastructure built in its initial stages.

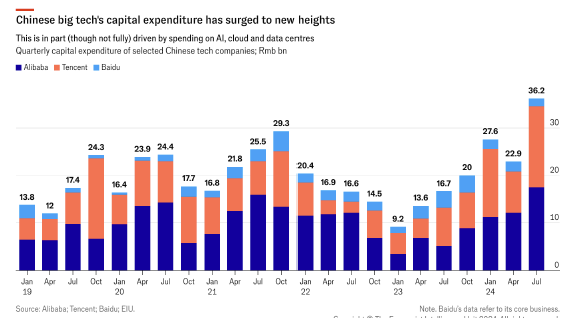

Tech-related investment and tangentially related industries vastly scaled back during the 2022-2023 regulatory storm. However, over the last year, due to the growth demand for generative AI, China has been mirroring global trends in pushing ahead with computing infrastructure and increasing capital expenditure, according to the latest EIU report.

Data from the government-backed think tank CCID Consulting indicates that more than 250 internet data centers have been built or are under construction as of June 2024. However, there is a worry that the state’s overly enthusiastic involvement could lead to less efficient use of computing power and eventual oversupply. Concerns were already raised mid-last year that China is experiencing an oversupply of computing power due to the AI boom (SCMP reported).

Some experts warned of a potential glut, as many data centers currently sit idle. However, this may not be a significant concern; the demand for computing power is expected to surge as AI technologies advance. However, during this growth stage, it is probably preferable to have excess capacity rather than face a shortage.

Source: EIU’s report China’s cloud, data centre and AI investment wave

After all, China’s overall spending on IT infrastructure seems to still pale relative to the U.S. According to the EIU’s estimates, China spends about 2% of its GDP on software, hardware, and IT services, compared to 5% in the U.S.

Source: EIU’s report China’s cloud, data centre and AI investment wave

That oversupply narrative was temporarily silenced when a September 2024 Morgan Stanley report suggested that hyperscalers in China have absorbed previous oversupply more quickly than anticipated, primarily driven by companies like Alibaba, Tencent, and ByteDance. Data center demand has surged recently, indicating a robust appetite for computational resources in the face of evolving technological needs.

Eastern Data, Western Computing: A Strategic National Initiative

China's ambitious “Eastern Data, Western Computing" strategy reshapes its digital infrastructure landscape. It addresses the growing demand for computing power in economically thriving eastern regions while leveraging the abundant renewable energy resources in western regions. The government is encouraging private and private sectors to follow the guidelines of this initiative as it not only aims to enhance computing capacity but also aligns with China's commitment to long-term sustainable development goals.

This strategic shift aims to alleviate the pressure on eastern data centers while utilizing lower average temperatures for cooling purposes, lower electricity tariffs and costs, and more readily available land in the west. The grand initiative, introduced in 2020, is a national effort backed by five federal-level agencies, including the National Development and Reform Commission.

Source: Premia Partners

The policy's rollout was applauded domestically, as it “helped to foster the data center and cloud service markets for over a decade,” wrote the EIU. This broadly aligns with President Xi Jinping’s goals to promote technological breakthroughs, enhance the resilience of industrial supply chains, and enable enterprises to become more productive and move up the value chain. Data center and cloud services, especially those directly related to AI development, naturally fell into that favorable basket.

The plan involves constructing eight computing hubs and ten data center clusters to facilitate a balanced distribution of computing power across China. Its goal is to create an integrated national system of data centers that enhances the planning and intelligent scheduling of computing resources. This effort aligns with China’s National Economic and Social Development strategy and Vision 2035, aiming to optimize resource allocation while supporting the country's ambitious AI objectives.

What led to this is that the majority of China’s data centers are currently located in the east (near the big cities such as Beijing, Shanghai, Guangzhou, and Shenzhen ‘北上广深’), where they are becoming increasingly costly and difficult to maintain. Lack of access to renewable energy also means many of these data centers rely on fossil fuels, contributing further to pollution and climate issues.

Some concerns relocating data centers to the West may lead to latency issues have been raised, but that’s a complete different discussion.

Renewable Energy Abundance in Western China

This kind of policy is not new in China. Over the years, the Chinese government has nurtured (jumpstarted) many industries with such policies, including the renewable energy sector. As mentioned previously, the state’s “invisible hand” has always been involved in China’s strategic development.

The EIU wrote that the central government has long played a significant role in guiding the market and local/ regional authorities in establishing a “national grid” for computing power to allocate resources better.

China's competitive electricity prices make it an attractive destination for energy-intensive industries. Western regions such as Shanxi and Guizhou offer some of the lowest industrial power rates globally, providing a significant advantage for data center build-out.

Renewable energy, albeit a way for a green transition, has also been preparing for this moment. It plays a crucial role in powering China's burgeoning data center landscape. While coal remains a significant part of China's energy mix, accounting for about 60% of electricity generation, ambitious targets aim to shift towards greener sources by 2025.

New data centers are expected to source over 80% of their electricity from renewables, a goal supported by current trends in which wind and solar capacities surpass traditional coal-fired plants. Current industry forecasts suggest that wind and solar capacity will overtake coal by 2026.

By strategically coordinating efforts across sectors—energy production and data center development—China can capitalize on its renewable resources to support increasing demands for computing power and artificial intelligence.

A few significant provinces that are already key to the initiative:

Inner Mongolia: This province is a leader in wind and solar energy production, boasting some of the largest wind farms in the country. Inner Mongolia's energy infrastructure supports low-cost electricity generation, which is crucial for powering data centers.

Guangdong Province: The southern province focuses on solar installations, capitalizing on its sunny climate to contribute to the overall renewable energy mix. It is also being encouraged to move data centers undersea to cut costs.

Sichuan Province: Renowned for its extensive hydroelectric capabilities, Sichuan generates approximately 85% of its electricity from hydropower. The province's surplus energy is often exported to more developed coastal regions, meeting the high demand for electricity in urban centers. It is also home to many data centers.

Future Demand for Data Centers Will Continue to Rise in China

Demand for data centers is anticipated to grow significantly as AI technologies advance. As highlighted by Premia Partners, AI could demand approximately 134 TWh of electricity annually by 2027—an amount comparable to the annual consumption of entire countries like Sweden or the Netherlands.

William Huang, Founder, Chairman, and CEO of GDS Holdings Ltd, said during the company’s most recent earnings call that the new demand for data centers, approximately ~ 70%, “was driven by the AI-type requirement” in China, for both training and also inference needs. The other 30% is driven by Internet companies and the traditional cloud business.

While short-term challenges related to oversupply exist, China's strategic investments in AI infrastructure and renewable energy position it favorably for future growth. Balancing supply with demand while ensuring sustainable practices will be essential. Time will tell whether all these factors can progress simultaneously.

FYI, I’m publishing a deep dive into the differences between China and the U.S. in cloud infrastructure build-out next week. Stay tuned.

Side rant: I am so impressed by Chinese acronyms and how beautifully four characters crammed together can sound so harmonious and make so much sense and compact so much meaning in it, “东数西算”- genius modern “chengyu.”

EDWC is just a small part of the National Unified Computing Power Network (NUCPN)...for more see https://www.nbr.org/publication/chinas-generative-ai-ecosystem-in-2024-rising-investment-and-expectations/