China's East Data West Compute, Understanding China's Data Center Energy Demand

Full Translation of China Energy Storage Network's Article on the Country's Data Center Industry

Hi All,

I’m working on a piece on China’s AI infrastructure build-up. It goes into how AI development is obviously driving up data center demands and energy consumption in the nation. In particular, a very interesting policy that I’m reading about is the East Data West Compute policy, which optimizes the abundance of land and renewable resources in Western China and collects the needed data in the more urbanized areas along the Eastern coastline from Beijing to Shanghai, and down to Shenzhen. Since this article still needs a bit more time, I thought I’d share a really well-written explainer by the State-Backed China Energy Storage Network article I came across. It explains the current situation in China well - think of it as a primer. I’ve translated and linked the article below for your reference.

Original content: ESCN 中国储能网

Author/ Editor: Meng Jin 孟瑾

Understanding the Data Center Industry in One Article

It is predicted that over the next decade, China's Internet Data Center (IDC) industry still has room for value growth, with an estimated compound annual growth rate of around 25% during the "14th Five-Year Plan" (a national policy) period.

Definition of Data Centers

A data center typically refers to an Internet Data Center, which is an electronic information system room that provides placement, proxy maintenance, system configuration, and management services for users' servers, network devices, and other Internet-related equipment on an outsourced rental basis, or provides the rental of computing, storage, software, and other resources, as well as the proxy rental of communication lines and export bandwidth and other application services.

A data center is a super-sized computer room that houses many computers and data communication equipment equipped with support systems for cooling, security, and operations. Through IDCs, operators can provide Internet Data Center (IDC) services and Internet Resource Collaboration Services (IRCS) services (also known as "cloud services").

Data centers are essential components of computing infrastructure. They are the data hubs and computing carriers that promote the development of new digital technologies, such as 5G, artificial intelligence, and cloud computing.

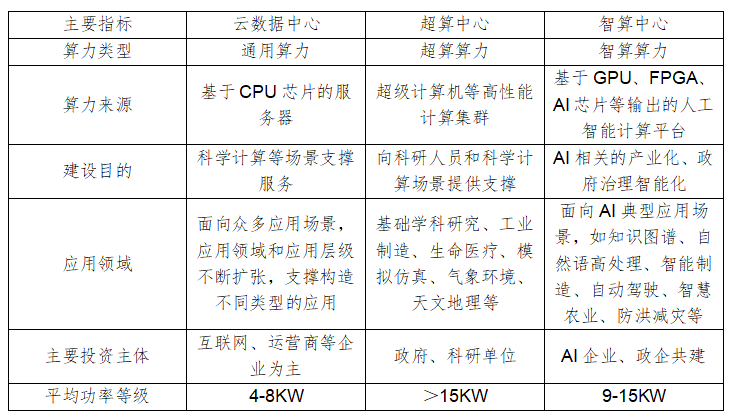

云数据中心: Cloud Data Center

超算中心: Supercomputing Center

智算中心: Intelligent Computing Center or AI Computing Center

Classification of Data Centers

Computing resources can generally be divided into three types: general computing power, intelligent computing power, and supercomputing power.

General computing power is based on CPU chips' computing capabilities. It has a broad range of application scenarios and does not require high precision.

Supercomputing power is the computing capability output by supercomputers, mainly used for scientific and engineering calculations, supporting high-precision scientific research fields such as astrophysics, meteorological research, and aerospace, with a greater emphasis on large-scale, high-precision complex calculations (double precision).

Intelligent computing power is based on the computing capabilities output by AI chips, such as GPUs, mainly used for AI model training and inference. For example, in AI scenarios such as autonomous driving and intelligent transportation, the precision requirements are relatively low (single precision, half-precision, or even integer calculations can meet application needs).

Based on computing power, data centers can be divided into three types: cloud data centers, intelligent computing centers, and supercomputing centers.

Cloud data centers face various application scenarios and expansion at various application levels.

Intelligent computing centers use AI-specific chips as the base for computing power. They aim to promote the industrialization and intelligence of AI and address typical AI application scenarios.

Supercomputing centers mainly support scientific and engineering calculations and are primarily constructed by the Ministry of Science and Technology. Therefore, third-party enterprises represented by construction central enterprises will pay more attention to opportunities to invest in and construct cloud data centers and intelligent computing centers.

Data Center Industry Chain

Upstream of the industry chain: mainly equipment and software suppliers, including civil infrastructure such as civil construction and construction contracting, cooling systems, power supply systems, telecommunications operations, etc., and IT infrastructure, including AI servers, network devices, storage devices, data center management systems, etc.

Midstream of the industry chain: mainly IDC builders and service providers, who integrate upstream resources to build efficient and stable data centers and provide IDC services, cloud services, and intelligent computing services. These are the core roles in the data center industry ecosystem.

Downstream of the industry chain: mainly industry application customers, the main users of data centers, including cloud merchants, internet enterprises, and other key industry users, such as financial institutions, government agencies, and other enterprise users.

Data Center Market Size

1) Strong national policy promotion, high-speed growth of the data center market

Driven by national policies such as new infrastructure, digital transformation, and the vision of a digital China, the scale of China's data center market continues to increase. According to a survey by the China Market Research Institute, the market's size in 2023 is estimated to be around 240.7 billion yuan, with a year-on-year growth of 26.68%. It is predicted that the market will reach 304.8 billion yuan in 2024.

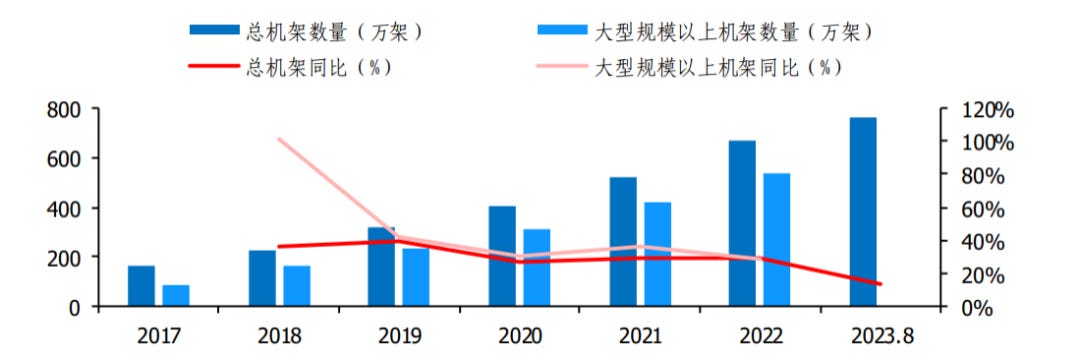

2) The scale of racks continues to grow steadily, and the scale of large data centers grows rapidly

The scale of data center racks in China continues to grow steadily, and the scale of large data centers multiplies. According to the standard rack of 2.5kW, as of August 2023, the total scale of data center racks in use in China exceeded 7.6 million standard racks, with a total computing power of 197FLOPS, and the total computing power has grown at an average annual rate of nearly 30% over the past five years. According to Kezhi Consulting, as of 2023, the average utilization rate of IDC cabinets in China is about 58%.

3) China's per capita intelligent computing power is insufficient, and the scale of intelligent computing is expected to continue to rise

The level of per capita intelligent computing power has become an essential manifestation of comprehensive national strength development. According to calculations by the China Academy of Information and Communications Technology, every 1 yuan invested in computing power drives 3 to 4 yuan of GDP economic growth. In terms of the total amount of intelligent computing power, the United States and China are in a leading position, accounting for 45% and 28% of the global share, respectively.

From the perspective of per capita intelligent computing power, the per capita computing power in countries such as the United States, the United Kingdom, and Germany is generally higher than 1000GFlops, while China is still at a medium level globally, and the computing power industry still has a large development space.

China's computing power industry maintains steady development, and intelligent computing power grows rapidly. In 2022, the scale of China's core computing power industry reached 1.8 trillion yuan, and computing power is accelerating its penetration into industries such as government affairs, industry, transportation, and medical care. It has made outstanding contributions to the growth of China's GDP. From 2016 to 2022, China's computing power scale grew by an average of 46% per year, the digital economy grew by 14.2%, and GDP grew by 8.4%. According to statistics from the China Academy of Information and Communications Technology, as of the end of June 2023, China's total computing power reached 197EFLOPS, of which the scale of intelligent computing power increased by 45% year-on-year, 15 percentage points higher than the overall growth rate of computing power.

Source: SenseTime’s new AI data center, one of Asia’s largest

Current Status of Data Center Development

China's computing infrastructure mainly includes supercomputing centers, intelligent computing centers, and data centers, all of which are under construction simultaneously.

1) Data Centers: Rapid growth, cluster layout

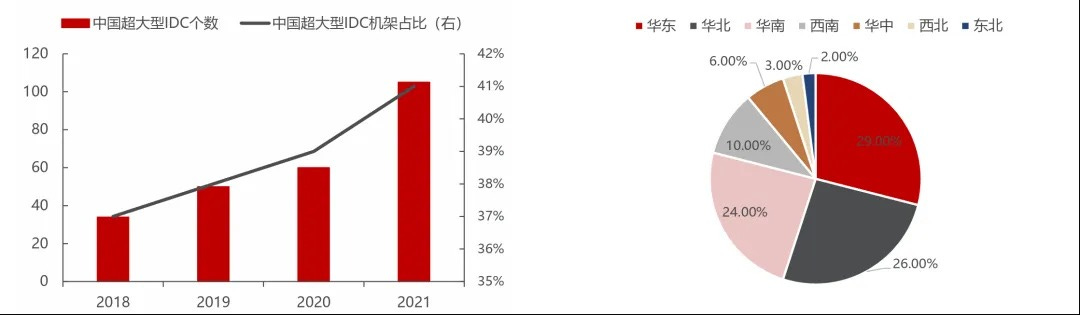

The growth of super-large data centers is rapid, showing a deployment trend from "center to surrounding" and "east to west."

In terms of scale, the number of super-large data centers in China has grown rapidly from 34 in 2018 to 105 in Q3 2021, with a corresponding rack proportion of over 40%;

In terms of region, data centers are mainly concentrated in the Beijing-Tianjin-Hebei, Yangtze River Delta, Guangdong-Hong Kong-Macao, and Chengdu-Chongqing regions. The four major regions of North China, East China, South China, and Southwest China accounted for nearly 90% of the existing cabinet proportion in 2021.

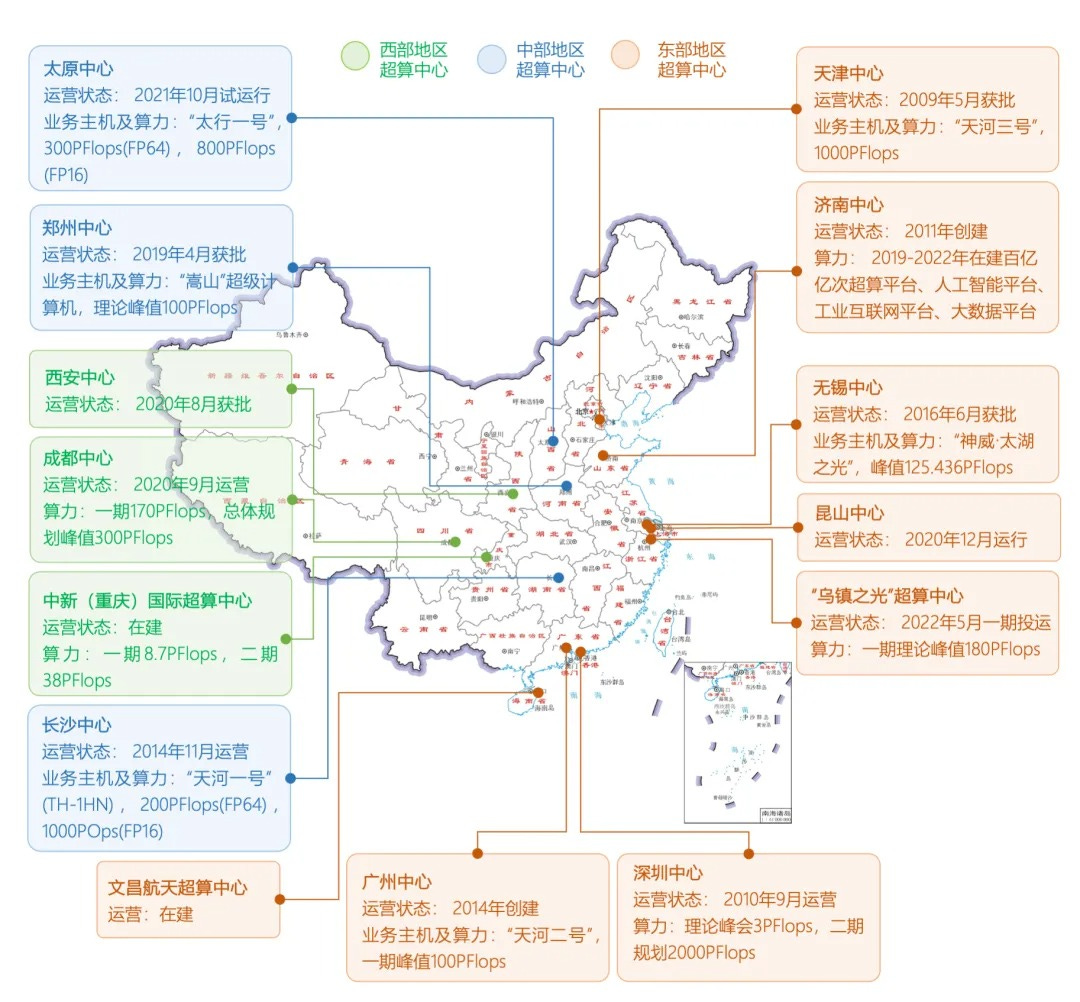

2) Supercomputing Centers: Stable pattern, Ministry of Science and Technology builds the national computing power base

According to the New Beijing Think Tank, since 2009, the Ministry of Science and Technology has approved a total of 14 national supercomputing centers distributed in Tianjin, Jinan, Wuxi, Kunshan, Shenzhen, Guangzhou, Changsha, Chengdu, Zhengzhou, Xi'an, Taiyuan, Wenchang, Chongqing, Wuzhen, and other places.

In addition to centers like the Wenchang Aerospace Supercomputing Center and the Sino-Singapore (Chongqing) International Supercomputing Center, the other centers have been put into operation.

3) Intelligent Computing Centers: Multi-point simultaneous development, relatively concentrated in the central and eastern regions

As of August 2023, according to incomplete statistics from the New Beijing Think Tank, at least 30 cities across the country are planning and constructing artificial intelligence computing centers, with a total construction scale exceeding 20 billion yuan. Regarding regional distribution, China's intelligent computing centers are concentrated in the eastern and central regions.

Data Center Industry Barriers

Qualification and licensing barriers are prerequisites for entering the industry, with regulations becoming stricter.

To conduct IDC business, companies must obtain the "Value-Added Telecommunications Business Operating License," which includes Internet Data Center and Internet Access services. Currently, the industry restricts foreign investment, making it nearly impossible for foreign investors to obtain an IDC license in China through wholly owned or controlled means.

Additionally, IDC development and construction regulation is becoming increasingly strict due to the scarcity of resources such as energy and land in first-tier cities. For example, in 2015 and 2018, the city introduced lists of prohibited and restricted industries for new additions in Beijing. The policy introduced in 2018 was even stricter, banning the construction and expansion of any data centers in the central urban area of Beijing and prohibiting the construction of data centers with a PUE value exceeding 1.4 across the entire city (outside the central urban area). In the future, Shanghai and Shenzhen may also further strengthen restrictions on data center construction. Moreover, cross-border mergers and acquisitions (M&A) regulation is becoming stricter, increasing the difficulty of entering the industry through external M&A. Since the second half of 2016, regulatory authorities have tightened control over cross-border M&A, and several listed companies have failed in their attempts to enter the IDC industry through external M&A.

Location advantage is evident, with regional economies of scale, and first-mover enterprises enjoy scarcity and first-mover advantages.

IDCs have real estate attributes, thus possessing a clear location and local characteristic advantage. Their value is greater, and they are closer to core demand cities. Therefore, IDCs surrounding first-tier cities like Beijing, Shanghai, Guangzhou, and Shenzhen are scarce. As land resources become increasingly scarce, companies that have established IDC businesses in core cities have a clear first-mover advantage, with increasing entry costs for latecomers.

Operational experience and service capabilities are the industry's invisible moat.

Besides providing basic hardware such as machine rooms and supporting facilities, IDC service providers must ensure the safe and stable operation of customers' servers and related equipment 24/7. Nowadays, the difference in infrastructure among newly built data centers is not very significant. However, operational experience, demand response capabilities, evaluations from well-known customers, and the stability of data centers have become critical considerations for data center clients.

On the one hand, the safe and reliable operation of data centers is crucial for the continuous stability of customers' businesses. The most common issues are related to power supply, leading to data loss for customers, as seen with Microsoft and Alibaba Cloud.

On the other hand, for cloud computing customers, the safety and reliability of IDCs are related not only to their own services but also to the data security of users of their cloud services. For example, Tencent Cloud once experienced an IDC failure that resulted in the company's complete loss of platform data worth tens of millions of yuan.

The rent of cabinets is just one crucial factor, but not necessarily the most important one. The ability to provide continuous and stable services is even more critical. Operational experience and service capabilities are becoming the intangible moat that high-quality data center service providers build.

Low-cost financial strength is a necessary condition for entering the industry.

The IDC industry is capital-intensive, and companies conducting IDC business require solid financial strength. Due to the significant differences in specific situations across various data center projects and the varying capabilities of companies in cost and expense control, even when building data centers of the exact specifications, costs can differ significantly. Generally speaking, taking a 4.4KW (20A) cabinet as an example, the average construction cost per cabinet is around 100,000 to 130,000 yuan. A medium-sized IDC project with 5,000 cabinets requires at least 500 million yuan in fixed asset investment. The trend is that the proportion of ultra-large-scale IDCs is increasing, and the threshold for fixed asset investment in an ultra-large-scale IDC has already exceeded two billion yuan. Companies with strong financial strength, especially those with low-cost funding capabilities, will have a clear competitive advantage.

Strong customer stickiness.

IDC service agreements are long-term contracts ranging from 3 to 10 years. Because changing suppliers may risk data loss, customers rarely change IDC suppliers. Long-term contracts and strong stickiness have established very strong user stickiness.

Overall, the IDC industry has characteristics of scale effects (strong regional scale effects), customer loyalty (strong), and qualifications (average). The increase in investment thresholds and the accumulation of customer service experience form a strong barrier to entry.

During the "14th Five-Year Plan" period, driven by the "East Data West Computing" strategy, China's data center industry has entered a new stage of development. The scale of data centers is steadily increasing, and a low-carbon, high-quality, and collaborative development pattern is gradually taking shape with enormous development prospects. Source: Liangjian Digital City.

Good insights. Thank you for the translations