Converting Crypto Mining Centers for AI Data Centers?

Are we entering a world of "Bitcoin Bros for AI?" A look into the opportunities and challenges of converting Bitcoin mining facilities into AI data centers

Alright, everybody, Bitcoin has hit over $100,000. So, for those of us who didn’t buy any five years ago, let us all be smacking our foreheads.

Today, we explore the two hottest industries that have emerged over the last decade. Crypto seems to have found AI, and the two sectors are finding surprising ways to work together.

So how does it work?

The Bitcoin bros that are active traders usually attract all the buzz and hype. But now, a massive group of companies typically in the background, supplying the infrastructure to mine the digital assets, are getting all the attention. And what these companies currently have is what AI data center operators wish they had:

1) land permits, 2) data center rental agreements, and 3) energy usage quotas.

For this piece, I had to start with the basics of Bitcoin mining, so bear with me. You’re probably all better versed on this topic than grandma, me.

Source: Taking a Look at Bitcoin vs. AI Energy Consumption ChatGPT generated image

It’s no secret that AI is gobbling down energy like a hungry cookie monster. However, the discussion has shifted towards better using existing resources or renewable options to power the demand.

For many hyperscalers who need access to power NOW, it’s been a challenge due to the long lead time, regulatory reasons, permit bureaucracy and challenging energy mix requirements. I’ve written about all of these extensively.

So, we’re seeing non-conventional solutions for hyperscalers to continue developing this technology. One that is garnering attention is converting crypto mining centers into AI data centers.

Before we even considered the possibility of converting Bitcoin mining facilities to AI data centers, I tried to understand how these “miners mine.”

First, the process of validating transactions and adding them to the decentralized ledger—the blockchain network—is called mining. Then, Bitcoin miners compete to solve complex math problems, which are, at this point, not done by an MIT Math wiz but by massive supercomputers. And the most crucial step here is solving the Proof of Work, which requires vast computational power.

It's possible to mine two cryptocurrencies at the same time. This concept is known as merge mining, but for the sake of this article, let’s assume all mining is done for Bitcoin, and the only crypto we’re referring to here is Bitcoin.

Bitcoin Bros for AI

According to the IEA, Bitcoin mining accounts for about ~1% of the global energy demand—that’s nuts. In Texas, the combination of Bitcoin mining and AI data centers' energy use accounts for half the grid's growth this year.

A multi-hundred million deal in August this year drew attention to this phenomenon when leading Bitcoin miner Core Scientific announced plans to significantly expand its AI business through a partnership with cloud provider Nvidia-backed CoreWeave. According to the press release, Core Scientific will modify a total of 100 MW of its owned infrastructure to deliver approximately 70 MW to host CoreWeave’s NVIDIA GPUs for HPC operations. The company expects to generate over $8 billion over the next 12 years through this partnership with CoreWeave.

Source: Yahoo Finance

So what we’re seeing now is that many Bitcoin miners are considering whether it’s more attractive to shift to artificial intelligence/ high-performing computing (AI/ HPC), remain in Bitcoin mining, or alternatively marry the two and do both. Bitcoin mining can happen almost anywhere with an interruptible load (for example, when the grid faces a power shortage, Bitcoin mining can shut down and stop). Still, AI/HPC requires a lot more land, fiber connectivity, access to water, data center expertise, and, most importantly, firm load (24/7 undisrupted energy supply).

Phil Harvey, CEO of blockchain data center consulting firm Sabre56, told Cointelegraph:

"There's probably around 20%, I would imagine, of each miner's portfolio that is actually capable of delivering key attributes like power, data, and land in order to facilitate AI."

Optimizing Energy Demand Response

Some argue that if Bitcoin mining can be done whenever, why do these data centers not convert themselves to AI data centers powered by solar energy during the day? The excess energy could then be used for Bitcoin mining.

Actually, that is taking place in some data centers in Texas. There are currently 30 Bitcoin mines across the Electric Reliability Council of Texas (ERCOT, Texas’ grid operator). Many are participating in what is called demand response, which means the user of the grid will shift the timing of when it uses the power based on the availability, such as shift usage to times when other demand is lower, and that helps ERCOT better balance its power supply and demand dynamics.

For example, everyone’s at home cooking dinner and watching TV between 6-9 pm; thus, we’ll see a surge in power demand across the state, and Bitcoin miners can pull in their mining activities to relieve some of the stress on the grid. Conversely, when everyone’s sleeping at night or when it’s 2 pm, and everyone’s at work/ school and the natural sunlight is likely enough to light the rooms, then the demand for electricity from civilians may drop so that Bitcoin miners can ramp up their energy use.

However, Morgan Stanley’s November report on Powering GenAI says that despite the chatter for a while, Bitcoin miners are unlikely to convert. Ultimately, it’s about the hash rate for the miners. Think of it as the opportunity cost for the miners.

The hash rate is the total computational power dedicated to mining new Bitcoins. At the same time, halving is an event that happens every four years consistently, which means every four years, the same input of energy results in half the Bitcoin output for the miners, making mining progressively harder with time and with more miners joining the network.

So, in a way, you can say that Bitcoin mining is becoming less profitable based on the same energy required, say, 12 years ago. However, the flip side of the argument is that the Bitcoin value today is so high that it seems more economical for miners to allocate that resource to Bitcoins because one Bitcoin gain can be much greater than the revenue generated by renting the facilities out for AI/HPC use.

The thinking for some of them is like this:

The Bitcoin price is high right now, so one might ask, why rent it for AI? You can make so much with Bitcoin mining;

BUT Bitcoin price is highly cyclical. A substantial AI data center deal, like the one mentioned above, offers a 12-year fixed price, and great certainty could be more attractive.

So, in the end, it’s a delicate balance between the certainty of an AI deal vs. periodically very attractive price & the risk of low-profit troughs

At this year's North American Blockchain Summit, held in late November in Dallas, crypto practitioners and policymakers in the digital asset ecosystem expressed optimism towards the crypto industry and the potential opportunities coming out of this space.

Source: X screenshot

In particular, there was a noticeable enthusiasm for a Trump 2.0 administration as the digital asset world seems to believe that the President-elect’s administration will have favorable legislation in place that could open up more investment projects.

Jaime McAvity, founder of West Texas-based miner Cormint, spoke with Woody Rickerson, COO of ERCOT, on a panel discussion on the use of energy for Bitcoin mining said that he was a skeptic of Bitcoin mining, but he has shifted his mindset and referred to the miners as “a helpful market participant” as they were able to shut down operations swiftly when there were electricity shortages.

Signs of “better understanding” of the industry seem to be adopted by regulators and more conservative parties in the ecosystem, which could lead to softer control on how Bitcoin mining facilities are being utilized/ converted too.

“After observing Bitcoin mining operations over the last few years, Rickerson thinks that these operations are an overwhelmingly positive member of an electrical grid community,” McAvity explained. “During our panel discussion, Rickerson noted that Bitcoin miners add a lot of value by providing free demand response – ERCOT now wants to build a good relationship with grid operators.” — Woody Rickerson, COO of ERCOT

Challenges in Conversion

However, challenges remain, especially in repurposing these projects physically. Converting Bitcoin mining centers to AI data centers isn’t as simple as repurposing existing infrastructure and machines because the requirements of the data network are different.

Sabre56’s Harvey noted that 90% or more of a mining company’s infrastructure would have to be replaced to retool the facility for data center usage. That’s not going to be a easy feat.

In fact, Needham analysts wrote in a May report that almost all the infrastructure miners currently have would “need to be bulldozed and built from the ground up to accommodate HPC,” or high-performance computing.

And challenges don't end there; below are a few other major hurdles crypto miners need to overcome before converting to AI data centers.

Infrastructure differences: AI data centers usually require more sophisticated cooling systems due to the enormous workload and heat outputs. (I’m working on a water usage piece that will come live in the next few weeks)

Space requirement: AI data centers often require more prominent space, but larger Bitcoin mining centers can handle the capacity.

Investment demand: The transition requires a significant upfront investment, which can be much more costly than a Bitcoin mining facility. Estimates suggest that AI data centers can cost between $3-$5 million per megawatt, a substantial financial burden for those footing the bill for the conversion.

The energy consumption pattern is different, which we’ve discussed extensively above.

Technical expertise: High-performance computing (HPC) skills are required to configure and optimize GPUs for AI applications, which is very different from what Bitcoin mining requires.

Permitting and licensing: The conversion could be regulated by local rules and laws, depending on location and existing infrastructure, which may require new permits and approvals.

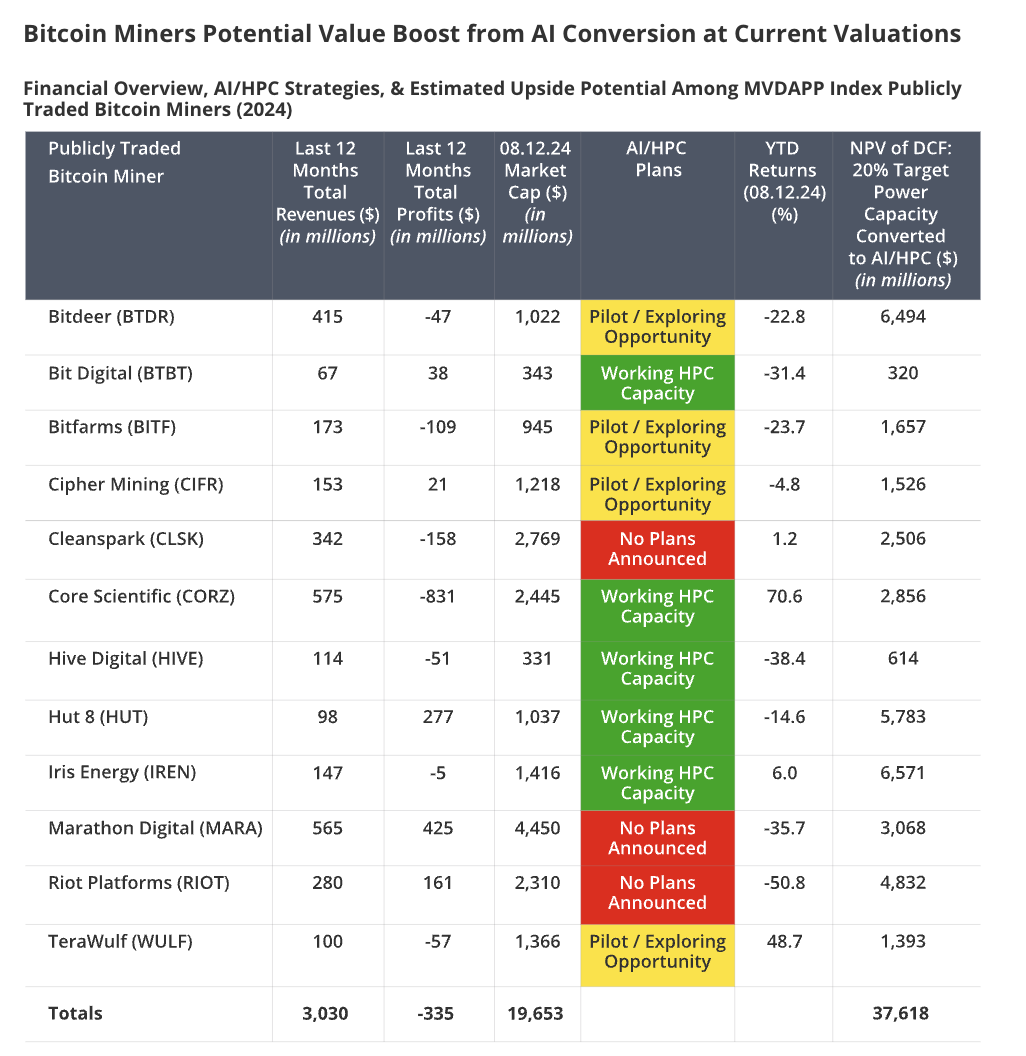

Source: VanEck

But ultimately (unfortunately sometimes only) money talks.

In a recent report, global investment manager VanEck claimed that Bitcoin mining companies could potentially gain $13.9 billion in yearly revenues if they dedicated 20% of their output to AI data processing and high-performance computing.

This significant amount of money probably won’t just be left at the door. So, whoever figures out how to convert first or optimize the existing resources for AI computing will be taking home the dough, and be solving a huge problem.

If we will need more energy to power the data center boom anyway, it’s probably better to see how we can optimize current available resources better. Especially if that means we can minimize waste and revamp certain under utilized facilities, and fix the energy bottleneck quickly, so be it…I’m here for it. #BitcoinBros4AI.

Thank you for your interest and support. Check out some of my top reads:

may i suggest? do your image generation using ideogram.ai

it is MUCH better at typography, in fact ideogram is THE best typography engine for english. Unfortunately there is no equivalent for Chinese typography (yet). AI generates pseudo hanzi that make my eyes hurt.

You know, Grace? No one can stop an idea whose time has come; what that means: is powerful persuasive ideas win by their ability to attract adherence, replication. We live in a world which is increasingly foolishly fearful. But when our ideas are correct, and our actions aligned with our ideals, we can achieve wonderful things. Ideas triumph or fail because they attract or repel support. The world will outgrow all its fears and grow into truly wonderful things.