Made in China AI Apps That You Are Using - Developed by ByteDance, Alibaba, Tencent, Meitu, BaiChuan, MoonShot AI, Baichuan AI, MiniMax

"China shedding?" Or maybe they're just staying low?

Amid an ongoing TikTok ban and a high profile lawsuit with the U.S. government, more and more Chinese companies in the last two years have been practicing what is referred to as the “China shedding strategy.” (see here for an analysis written by my talented dear friend Ivy Yang)

Essentially, what many companies are doing is either not bringing up that they’re China-made/ China-backed or straight up setting up a legal entity in a geopolitically neutral location, such as Singapore and marketing itself as a Singapore company despite capital, talent, and management all being Chinese (I wrote about how Singapore is courting Chinese AI companies for The Diplomat, republished here). Or a growing number of Chinese developed AI applications are simply keeping a low profile.

But what is super underappreciated now is the fact that:

China’s big techs have created a whole separate and vibrant ecosystem in China in terms of models and applications

Many of the applications that are available outside its home market are actually remaining very low-key, despite widespread popularity at home and abroad. And because Chinese tech firms often have a strong grasp on consumer experience, these apps are just genuinely pleasant to use

On the first point, China has created a completely separate AI ecosystem for a few main reasons:

to lessen dependency on US-centric technology

to not become too successful/ high profile and get banned like TikTok

the Great Firewall censorship constraints that requires information to be filtered, diluted, have “core socialist values”

And on the second point, the consumer savvy internet companies are widely behind the popular AI apps on the market today, think of the likes of Alibaba, Huawei, ByteDance, but also rising stars like - Zhipu, MiniMax, Moonshot, and others, are just keeping a low profile.

According to McKinsey’s latest report on AI in China, the majority of AI technology is currently used in the consumer facing tech sector in China. It is believed that in China, enterprise software companies can unlock substantial value—an estimated USD 80 billion—through data infrastructure, middleware, and SaaS by offering AI-driven solutions to various industries. Of the total, USD 45 billion is attributed to Data and Middleware, driven by cloud databases that reduce operational costs, integrated AI algorithms and APIs that streamline AI model development, and MLOps for automated efficiency. Additionally, USD 35 billion comes from SaaS applications utilizing machine vision, speech recognition, natural language processing, and image/video processing, which could aid sectors such as finance, HR, supply chain management, and cybersecurity use cases. There is so much innovation in China and created by Chinese tech companies that not going noticed in the West.

(I spent two weeks working on a deep dive on Alibaba’s AI strategy where I spoke to industry experts, people within Alibaba, went through corporate filings, company announcements, executive interviews and dug into my own brain for history, context and personal experiences. I am planning on rolling out a series of China big tech deep dives and some of these will be published as guest posts, such as the one here on AI Supremacy - Alibaba, the company behind Qwen)

ByteDance, Alibaba, Tencent and the newcomers

In China, the tech giants Baidu, Alibaba and Tencent, were collectively known as "BAT". The three tech behemoth had been at the forefront of China’s first internet revolution and laid the foundations for the astronomical growth of the country’s search, ecommerce and gaming technologies. Prior to the regulatory crackdown on anti-monopoly in the tech industry, they were also China’s most prolific tech investors, incubating, grooming and playing a vital role in China’s consumer technology ecosystem.

Technological changes have always been an opportunity to reshuffle the industry. From the Internet to the mobile Internet era, ByteDance has replaced Baidu and become the B in the “BAT” essentially. (Although Baidu seems to be having a comeback moment which I’ve shared some key takeaways from its recent product showcase event here, and I’m working on a BAT earnings wrap, similar to the one I did for US big tech, as Baidu just had its big annual event and Tencent and Alibaba’s quarterly announcements will conclude by the end of the week too.)

Most notably the new BATs are all rushing to back what has been locally nicknamed as the “new four AI tigers”: Moonshot AI, Baichuan AI, Zhipu AI, and Minimax. [The old AI tigers being SenseTime SenseTime, Megvii, CloudWalk Technology and Yitu Technology – which focused mostly on facial and image recognition technologies].

The four have been helped largely by the bigtechs as they propelled each of them to monumental success of raising hundreds of millions and reaching valuations of USD 2-3 billion (I wrote about Alibaba’s strategic investment across the ecosystem here). These strategic investments and partnerships by the big tech mean that they’ve really locked in the technological access, potential financial reward and the four companies’ loyal dependency on the big tech’s infrastructure services.

In the beginning, the four tigers lauded and welcomed the recognition, the capital and support from big techs, but there has been rumors that there is a change in attitude. Although they continue to raise capital from big tech players, they’ve begun to raise an issue that is being talked about in the China AI space right now – none of these companies have their own infrastructure. That means they’re all heavily dependent on companies such as Alibaba, ByteDance to offer compute capabilities and cloud service, and they seem to have only recently realized this.

So what we’re seeing is that they’re all pivoting from their original LLM-focused research/ business model, to being more focused on innovating in the application-end hoping to monetize through apps such as Kimi (Minimax), Moonshot (namesake app), AutoGLM (Zhipu) and more. Given that they’ll never be able to compete with the big players in offering developers the whole package of cloud, compute and LLMs. There even is consensus in the industry that these smaller companies may either get swallowed or will have to consolidate one day.

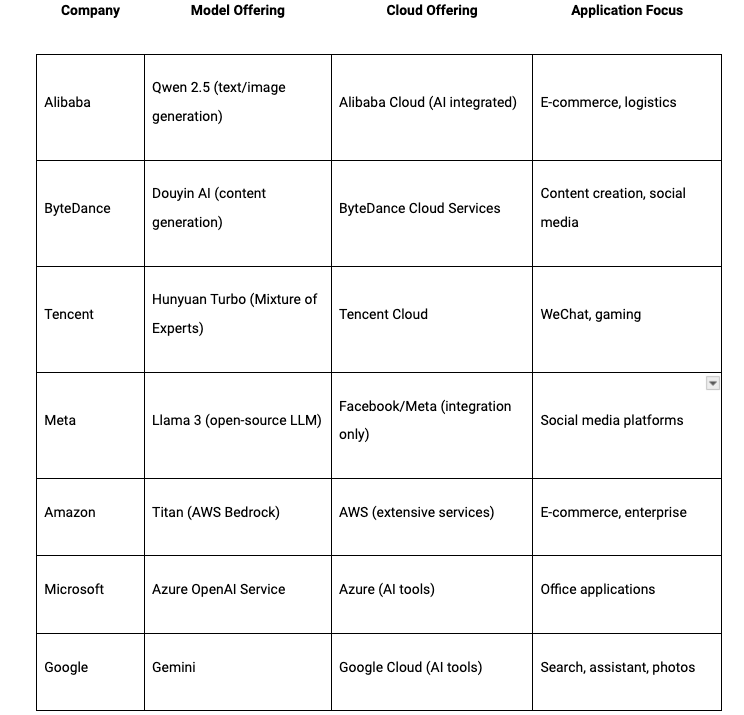

To give you a rough sense - apples to apples: US vs China

Source: Perplexity generated - information fed/ questions prompted by Grace

If we had to roughly categorize them and compare them:

Alibaba is more like Amazon. Having a strong cloud business and an advantage in its LLM. Though the difference is Alibaba's Qwen series are open source and Amazon’s partnership with Anthropic isn’t open source.

Alibaba’s open source Qwen is more like Meta’s Llama but then Meta doesn’t have a cloud business.

Huawei’s Pangu is largely targeting enterprise clients and not open source, much like Microsfot backed OpenAI’s proprietary GPT4.

Whereas Google and Baidu share a search engine heritage and so far working mostly more quietly on the application innovation front.

So on a lighter note, let’s take a look at some of the offerings these Chinese big tech currently have launched and are available in the U.S.

According to Unique Research, and AIGC’s joint report (see list below). The most downloaded AI apps globally are below, of which it clearly labels which ones are targeting the Mainland China market and which ones are by foreign companies.

Source: WEF - what I call the OLD China AI World

Based on desktop research, word of mouth and my own trial and errors, I have selected some of the most popular AI apps/tools on the market that all have a Chinese heritage - aka developed by a Chinese company. [This list is partially generated by AI]

Video/ Image Editing

1. Kling AI: Developed by Kuaishou, a powerful video generation model that allows users to easily and efficiently complete artistic video creation.

Developer: Kuaishou

Kuaishou is a well-known short video platform. Probably second most used short-video platform after TikTok (Douyin in China). It mostly targets second and third-tier cities in China with more purchasing incentives. The creators on the platforms are often farmers or fishermen or factory staff who are selling their agricultural goods or manufactured goods directly to customers. Kuaishou’s large model team has independently developed the video generation model "Kling AI," showcasing the company's technical strength and innovation capabilities in the field of AI. Kuaishou Technology was listed on the main board of the Hong Kong Stock Exchange in February 2021 with the stock code: HKG: 1024.

2. CapCut: Launched by ByteDance based on the DouBao large model, the AI platform mainly includes AI image creation and video generation.

Developer: ByteDance

ByteDance is a global technology company known for its short video platform TikTok (the Chinese version is called Douyin). The short-video platform is most popular amongst so called “first-tier” cities in China where users have a higher purchasing power and are more drawn to fashion, lifestyle and pop culture content. The company has in-depth research and application in the field of AI, launching the "Ji Meng AI" platform, demonstrating its strong capabilities in AI technology and creative content production. ByteDance is a privately held company (that has been trying to go IPO for years but is stuck in a rock and a hard place with the ongoing US lawsuit and domestic regulatory contraints.)

3. Meitu: a free mobile photo and video editor. With Meitu's advanced AI Art techonology, you can effortlessly generate unique anime-style pictures with just a single tap.

Developer: Meitu Inc.

Meitu has largely focused just on image and video editing, it is an AI-driven technology company that was founded in 2008, it is probably the most downloaded image editing tool and it says it carries "beauty" as its core ideal. Meitu uses AI to offer automatic filtering, makeup application, editing of photos based on the subject/ portrait/ landscape/ style you select. Meitu was listed on the main board of the Hong Kong Stock Exchange in December 2016 with the stock code: 1357.HK.

Office Assistance

1. ChatBA: Developed by Moonshot AI, an AI PPT generation tool for automatically generating slides.

Developer: Moonshot AI

Moonshot AI is a company focused on artificial intelligence technology, launching products such as Kimi Chat, which has AI autonomous search capabilities, reflecting the company's R&D strength and innovative spirit in the field of AI.

2. China’s ChatGPT: Kimi and Doubao

My two favorite Chinese chatbot tools for Chinese language/ China-related work are Kimi developed by Moonshot and Doubao developed by ByteDance. They pretty much operate like ChatGPT/ Perplexity but can do everything in Chinese better. Check them out if you need to research and summarize in Chinese language for your work.

Developers: Moonshot AI and ByteDance

There are many many other quality applications out there, and I am still exploring. Leave a comment and let me know of any other amazing apps I’ve missed here/ and should try!!!

this articles is really help full and help me to understand how Ai and meitu revolution in editing world of photo editing and video ehancement by using advance features. largest company like alibaba how its cloud space help meitu to available as vast level. just exploring meitu see its its detail guide from meitumod.com and amaze to see the features and how its help in real editing solution to the users.

This is the analysis on the state of AI play we need we need. Amazing work, Grace!