Learnings from East to West

What we can learn from China’s technology companies and their AI strategies.

Hi, everyone!

This post was initially published as a collaboration in Ollie’s newsletter, New Economies. I’ve made some minor alterations to the content to suit my style better. Please check out New Economies, where Ollie explores the latest tech trends. Ollie started his career in the VC world and has now taken his passion for supporting startups and VC investors to his consultancy/ research business.

China has always played a significant role in the global economy, and we are seeing a new wave of technologies entering and flooding Western markets inspired by what is taking place in the East, especially in the AI space.

The Rise of the Quiet AI Apps

Eight of the 50 on Fortune’s AI Innovator’s List are Chinese; however, they mostly go unnoticed in the U.S.

Chinese tech companies have previously spent heavily on marketing to win the hearts of millennials and Gen-Z consumers in the West, from PDD Temu’s 2024 Super Bowl ad to Shein’s various collaborative campaigns, including one with Sriracha in Times Square. But today, we’re seeing AI applications taking a page from the fashion playbook and adopting a “quiet luxury” approach.

The eight Chinese firms on Fortune’s 50 AI Innovators List

What we’re seeing is that big Chinese tech developers are quietly rolling out products and taking up market share in the West without making a splash about it. Whether it's to test the product-market fit first or for regulatory reasons, many Chinese companies do not mention that they were born out of China. Some platforms, such as Singapore, are going the extra mile to set up a legal entity in a geopolitically neutral location, as I wrote here — ’ Singapore Is in Perfect Position to Court AI Companies From China.’

Many of these platforms are adopting the so-called “China shedding strategy.”

Since Trump began targeting TikTok in 2020, demanding that ByteDance sell its U.S. business or face a ban, Chinese tech companies have grown increasingly cautious. Kuaishou Technology launched a U.S.-based short-video app called Zynn, but it was swiftly shut down amid escalating tensions between the two nations (and sensitive industries) in late 2021. Meanwhile, Shein, the online fast-fashion retailer, shifted its 2025 IPO ambitions from New York to London. The consensus now is clear: everyone is playing it safe, and no one is willing to take unnecessary risks.

Chinese Apps’ Competitive Advantage

In China, tech giants such as Alibaba, Baidu, Tencent, ByteDance, Xiaomi, and Huawei have been at the forefront of China’s first internet revolution. From software to hardware, they laid the foundations for the astronomical growth of the country’s internet industry. As of today, they are still China’s most prolific technology platforms, incubating, nurturing, and playing a vital role in China’s consumer technology ecosystem. [I have previously wrote about Chinese-developed AI apps that are widely used in the West.]

These tech giants are leveraging their expertise from the mobile internet era and applying it masterfully to the age of AI—the greatest technology shift in recent years. Their strength lies in creating user-friendly applications powered by cutting-edge innovations and highly effective business models. We take a closer look at their playbook.

Large user base: Piggybacking off of the internet giants, with Alibaba’s ~935 million MAU on its Taobao app, Tencent’s WeChat ~1.38 billion MAU, ByteDance’s Douyin ~1 billion MAU in China alone, and TikTok ~1billion global MAU, there is just so much user data to learn from.

Mobile-centric design: In China, consumers skipped past the credit card era and the desktop MSN era. Most went straight from no internet to smartphones. This means they often have much savvier intuitions when it comes to mobile app adoption. Chinese applications are optimized for smaller screens and touch interactions, prioritizing seamless user experiences that cater to on-the-go usage.

Super apps and multiple touch points: Platforms like WeChat and Alipay serve as super apps, integrating multiple functionalities—messaging, social media, e-commerce, and payments—into a single interface. This consolidation simplifies user interactions and enhances convenience, allowing applications to have various touch points with users through these super apps. Chinese developers have the ability to be more nimble and agile with Product-Market-Fit testing, and this is something suprisingly Lee Kai Fu also talked about in a recent interview. See link to transcript to Lee’s interview in Chinese.

translates and provides his insights.Strong integration of payment solutions: Seamless integration of payment systems within apps such as WeChat and Alipay has made it much easier for users to engage in e-commerce and other financial activities without leaving the app environment. Through these integrations, companies can also study user consumption behavior beyond just social activities.

Below, we take a closer look at how Chinese apps are being adopted globally, but first I want to thank for his insights below and whipping up these awesome infographics for this piece.

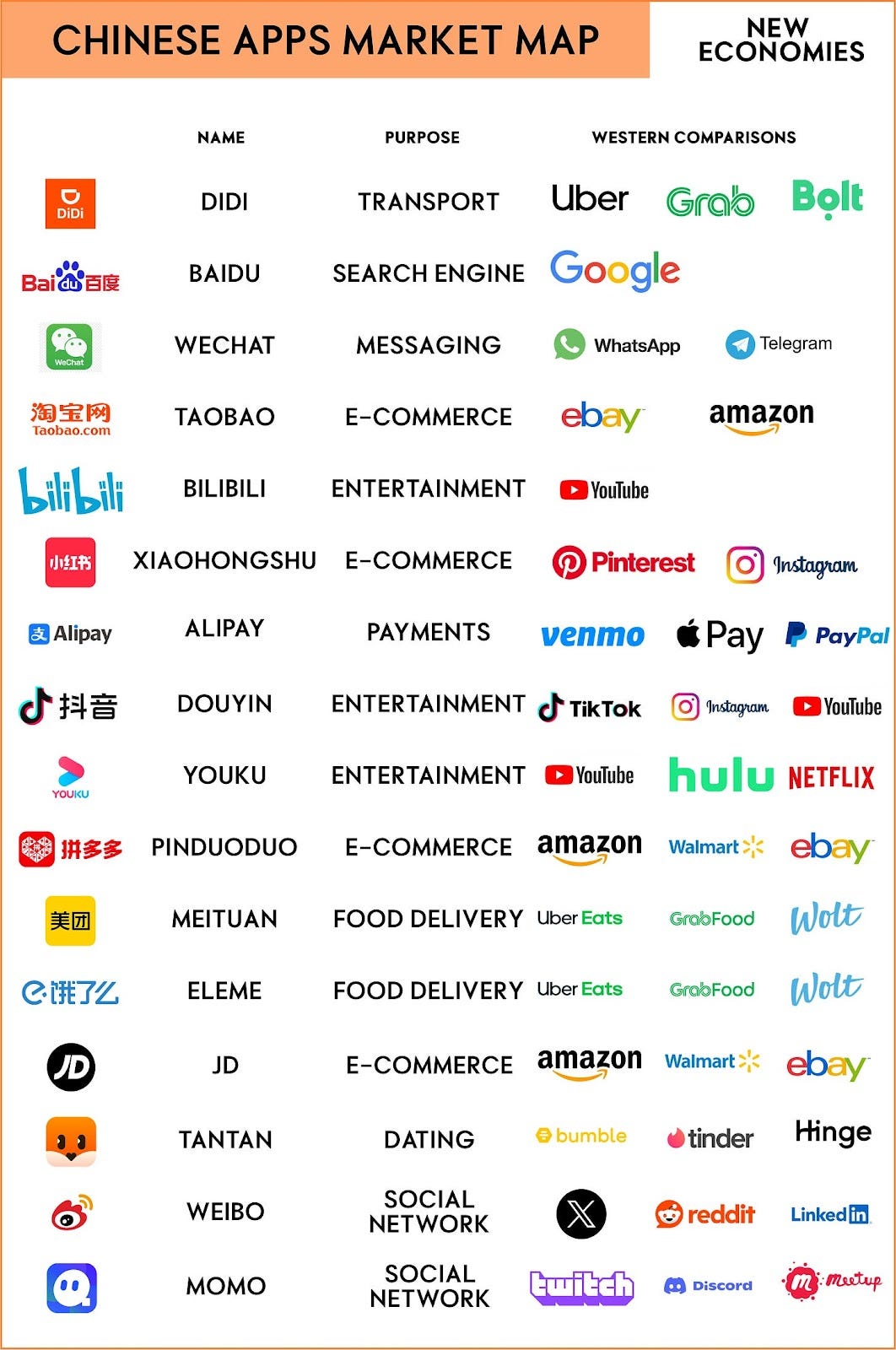

The Adoption of Chinese Apps

Thirty years ago, when we thought of “Made in China,” we thought of the physical products that had been manufactured in Chinese factories. However, we are now witnessing a significant shift in the kind of goods China exports, as an increasing number of Chinese software have captured Western markets, and new AI apps are emerging to take on both local and global markets.

Take TikTok, for instance—a platform with over a billion users worldwide. Other examples include Lark (also developed by ByteDance), a collaboration tool akin to Slack; CamScanner, one of the most widely used document scanning apps globally; and ShareIt, a popular file-sharing app. These innovations, originating from China, are making a solid impact in Western markets.

The Power of Super Apps

And then there are super apps. Super apps are massively popular in China and even across Asia due to cultural, economic, and technological factors that foster their growth and adoption. The most prominent ones in China are WeChat and Alipay, and Grab in Southeast Asia or Kakao in Korea (and many more) often integrate diverse services, such as social media, e-commerce, payments, transportation, all into a single platform, creating a seamless digital ecosystem for users.

Why are they so popular?

A. Everything you need in one place

Chinese/Asian consumers are mobile native. Many actually skipped over the PC era and jumped right into a smartphone adopter. They prefer to have everything happen at once on one interface.

B. User experience

Western applications have a much cleaner design, mainly a white UX background, with simple buttons for purchasing. In contrast, Chinese apps are very busy with colorful pop-up ads, buttons to like, and give flowers or gifts to creators - and they actually like the busier designs (see Taobao vs. Amazon).

C. Owning the customer journey

Chinese tech companies like to own the whole service chain, similar to Alibaba (marketplace, payment, logistics all within Alibaba). JD also has its logistics arm and set up WeChat pay as the default payment option (being part of the Tencent camp), has its own robotics-driven warehouse, and even cargo air options.

For more on China’s EV sector and AI Unicorn landscape, check out Ollie’s newsletter.

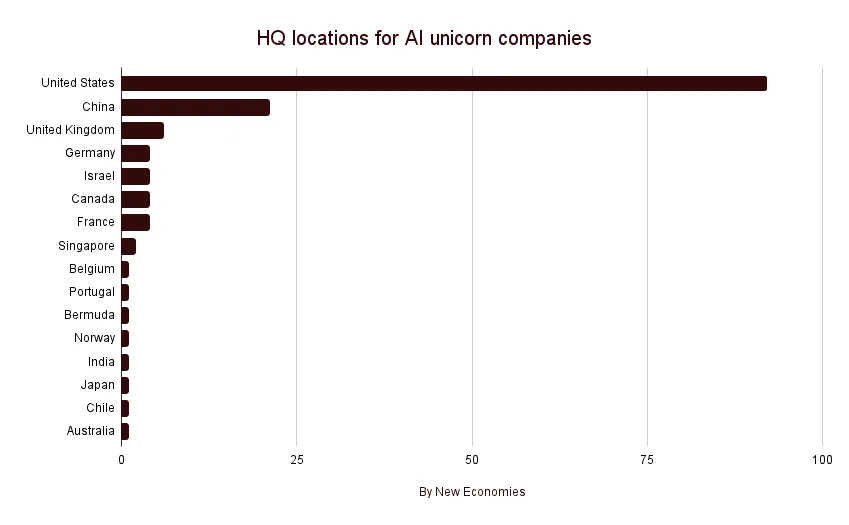

New Economies recently mapped out the AI Unicorns Landscape below.

Help this post reach more readers by clicking the ❤️ at the top of this post!