China's AI Startups Pivot Amid DeepSeek's Rise

China’s AI Startups Shift Focus to Consumer Apps and Vertical Markets to Stay Competitive

Hi all,

The dust has settled, and the hype surrounding DeepSeek has tempered. Since the release of the R1 model, both hyperscalers and LLM startups have revisited their business strategies. And China’s AI startups are undergoing a strategic transformation as competition intensifies. Once focused on foundational large language models (LLMs), these companies are now shifting toward consumer applications and vertical markets, aiming to carve out sustainable niches in a crowded field.

While mainstream media has highlighted China’s EV and home appliance sectors adopting DeepSeek’s technology, these integrations remain largely consumer-facing enhancements. The more significant impact has been on China’s LLM startups - more specifically, the “four tigers,” which are now rushing to make a second pivot.

Big Tech Remains in the Lead

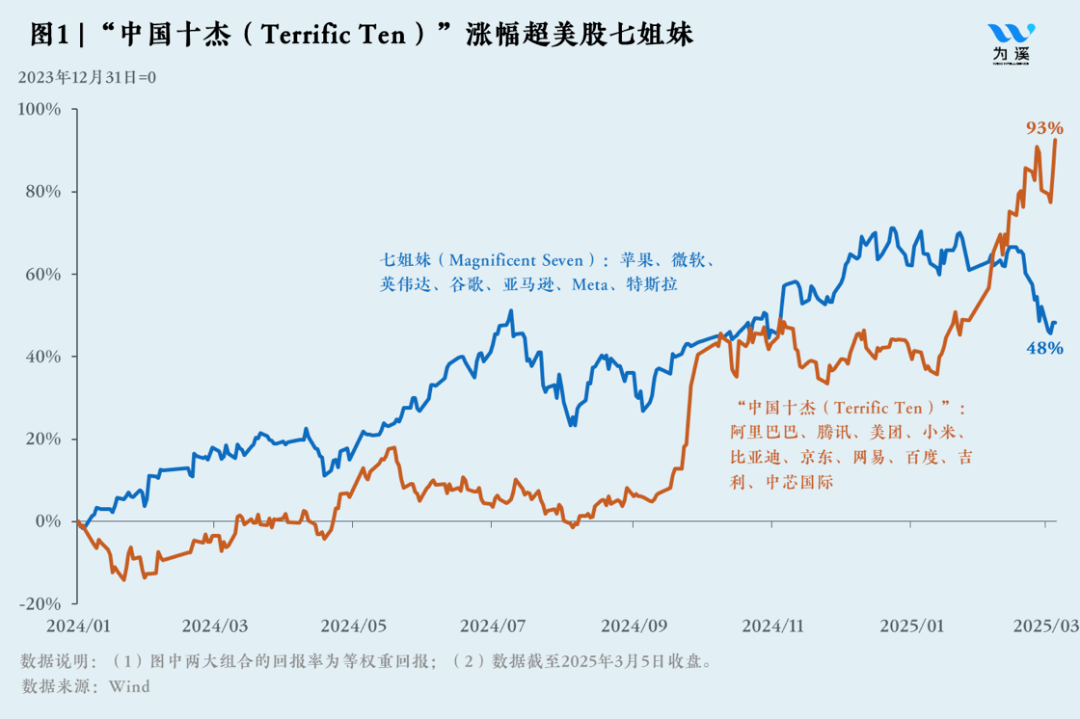

Despite the shifts among startups, the biggest winners remain China’s tech giants since DeepSeek’s R1 release. As seen in the screenshot of the WeChat account Weixi, the "Terrific Ten" has seen a 93% return year-to-date, far surpassing the 48% growth of the U.S.'s "Magnificent Seven." This underscores the dominance of incumbents in capital-intensive areas like the models and infrastructure layers.

The Strategic Shift Among Startups

The original “AI four tigers”—Zhipu, MiniMax, Moonshot AI, and Baichuan—were once leaders in China’s LLM space during the peak of AI hype. Over the past two years, as big tech began catching up with proprietary LLMs, these startups pivoted toward consumer-facing applications with tools like Kimi, Talkie, and Hailuo. However, following DeepSeek's R1 release, the landscape has become crowded, and expectations for free and accessible frontier LLMs have risen.

In response, these startups are revamping their strategies yet again. According to an analytical piece by The Financial Times, they are now shifting focus to enterprise solutions to remain competitive amidst DeepSeek’s widespread adoption across China. Notably:

Baichuan: Narrowed its focus to healthcare applications and established itself as a leader in this vertical.

Moonshot AI: Reduced marketing efforts for its Kimi chatbot to prioritize model training and performance improvements.

Zhipu AI: Strengthened enterprise sales while preparing for an IPO and continued developing open-source AI models.

MiniMax: It seems to be staying put as of now. Staying focused on its consumer apps.

Even 01.ai, the AI startup founded by Lee Kaifu has stopped pre-training large language models to focus on selling tailored AI business solutions using DeepSeek’s models. This shift reflects a pivotal moment where hyperscalers dominate infrastructure and model layers due to their ability to invest heavily in R&D. Startups are increasingly focusing on application use cases, and more specifically, with vertical expertise— similar to patterns seen during the internet era.

Timeline of Strategic Adaptations

Let’s just take a look at the timeline, which was put together with the help of Perplexity Pro.

Pre-2023: Initial Business Strategies

Baichuan: Founded in April 2023 by Wang Xiaochuan, Baichuan initially focused on developing open-source LLMs. They released models like Baichuan-7B and Baichuan-13B in 2023, aiming to contribute to the AI research community and establish a foothold in the foundational model space.

MiniMax: Established in December 2021 by former SenseTime experts, MiniMax concentrated on creating LLMs and multimodal AI systems. Their early efforts were directed toward foundational AI technologies, including the development of the MiniMax-01 model.

Moonshot AI: Founded in March 2023 by Yang Zhilin, Moonshot AI aimed to develop LLMs capable of handling extensive text inputs, emphasizing long-context processing capabilities. This focus was intended to address complex language understanding and generation tasks.

Zhipu AI: Established in 2019, Zhipu AI initially concentrated on building LLMs and providing AI solutions tailored for enterprise applications, targeting sectors such as local governments and various industries.

2023–2024: Pivot to Consumer Applications

As the AI market evolved, these companies recognized the potential of consumer-facing applications and adjusted their strategies accordingly:

Baichuan: Transitioned towards developing AI applications for the healthcare sector, including an AI doctor assistant designed to aid in medical diagnoses.

MiniMax: Launched consumer apps like "Talkie" and "Xing Ye (星野)." "Talkie," introduced in June 2023 for international markets, allows users to create and interact with virtual characters. "Xing Ye," released in September 2023 for the Chinese market, offers similar functionalities.

Moonshot AI: Developed "Kimi," an AI chatbot that gained popularity for its conversational capabilities. However, the company faced challenges related to service outages and increased competition, prompting a reevaluation of their focus.

Zhipu AI: Expanded into consumer applications while continuing to build its enterprise business, offering personalized AI solutions to local governments and companies.

2025: Strategic Shifts Post DeepSeek

The introduction of DeepSeek's R1 model in late January 2025, noted for its rapid adoption and advanced capabilities, prompted these companies to reassess their strategies:

Baichuan: further narrowed its focus to the healthcare industry, emphasizing the development of AI tools for medical applications. It has successfully established itself as a vertical leader.

MiniMax: Continued to innovate in consumer applications, enhancing products like "Talkie" and "Xing Ye," and developing new AI-driven features to maintain a competitive edge.

Moonshot AI: Reduced marketing efforts for "Kimi" to concentrate on improving model training and performance, addressing previous service challenges, and aiming to compete more effectively with leading models like DeepSeek's R1.

Zhipu AI: Focused on strengthening its enterprise sales, aiming for an initial public offering (IPO) to fund growth, and continued developing open-source AI models to enhance its offerings.

These strategic adaptations reflect the dynamic nature of the AI industry, which is moving fast. As incumbents dominate in capital-intensive areas, startups must continually evolve to align with technological advancements and market demands and find their niche to dominate.

LLM Consolidation Trends

The consolidation of LLM ecosystems is not unique to China. According to Morgan Stanley's March investor insights, software companies globally aim to create larger operating systems powered by machine learning, natural language processing, generative AI, and decision-making algorithms. These systems could prove valuable across consumers, enterprises, creators, and advertisers.

In China:

Tencent monetizes through ads and value-added services.

Alibaba focuses on cloud-based revenue streams.

However, industry leaders like OpenAI CEO Sam Altman argue that subscription-based productivity tools may offer greater long-term value than advertising models. Altman believes consumers will pay for superior productivity-enhancing products rather than rely on ad-supported systems during an interview with Stratechery’s Ben Thompson. In contrast, tech strategist Ben Thompson suggests that OpenAI could leverage its data trove for targeted ads, and as it does not have an existing business to protect, it can just yolo a bit. A strategy incumbents Google has had to approach with much more caution due to risks of cannibalizing its Search business.

One thing that is clear is that for startups without existing platforms or cloud monetization capabilities, innovation lies in creating entirely new solutions tailored to niche markets. As consolidation continues among hyperscalers like the Magnificent Seven in the U.S. or the Terrific Ten in China, incumbents remain well-positioned to dominate the value chain.

Made-in-China Apps 2.0

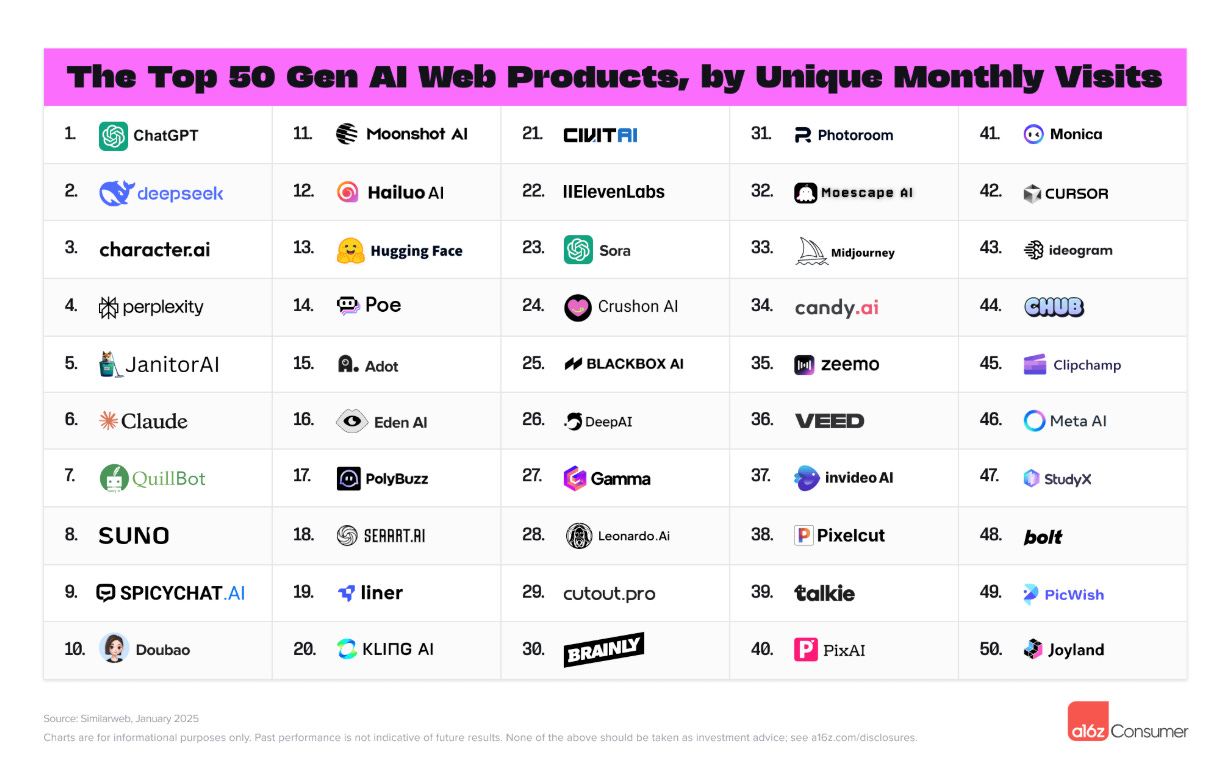

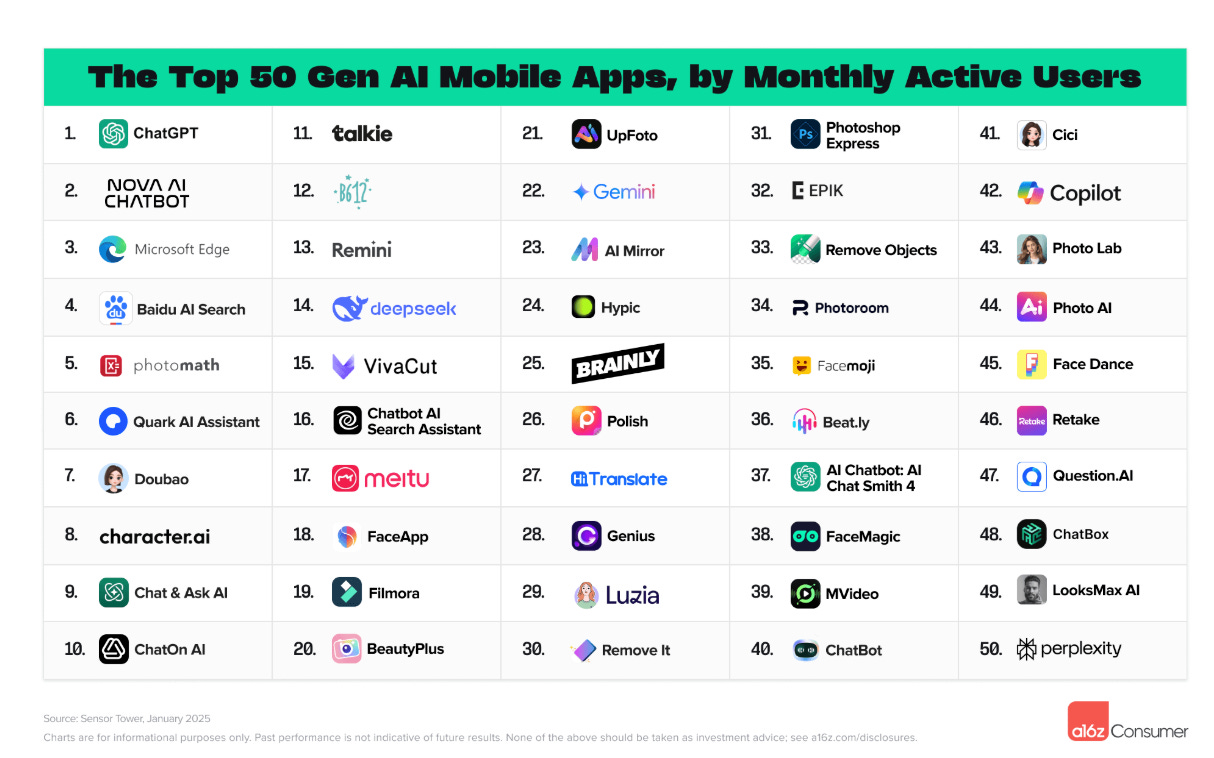

As a sequel to the Made in China AI Apps piece I wrote, I thought I’d provide an update based on this super comprehensive list a16 put together: Top 100 GenAI List.

According to a16z's list, DeepSeek ranked second behind ChatGPT among web-based GenAI apps by monthly visits as of March 2025. Other notable Chinese apps include ByteDance’s Doubao, Moonshot's Kimi chatbot, MiniMax's Hailuo and Talkie Kuaishou’s Kling, Cutout.pro, monica.ai’s Manus, which have all made it into the top 50 rankings globally.

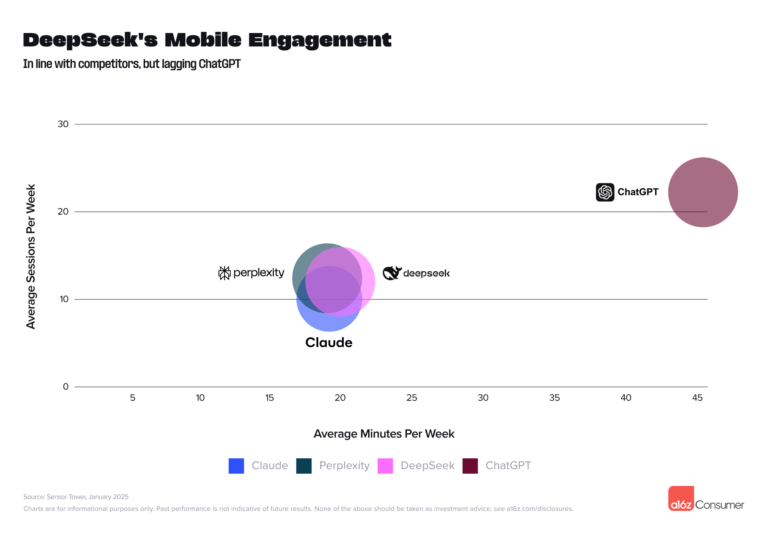

Chinese consumer adoption of mobile apps remains strong due to higher penetration rates compared to Western peers—a trend evident from DeepSeek’s high engagement metrics. And the reason for consumer adoption being so high can also be attributed to just simply a relatively low cost for innovation diffusion.

What’s interesting is that DeepSeek’s mobile engagement is extremely high. This goes back to my point about Chinese consumers’ adoption of mobile apps being much easier to penetrate than Western markets, given its embrace of the mobile-omnipresent nature and super-app culture.

“Consumers are happy to use anything that is free, but corporate is not going to spend even the soft costs if they do not have a line of sight to the ROI,” wrote inBernstein’s AI report, written by various analysts but led by Mark L. Moerdler, Ph.D.

This has been proven by the sheer number of downloads and engagement for DeepSeek compared to non-free peers. Consumers are less interested in geopolitics and more interested in cost-efficiency and user experience. (Enterprises, however, otherwise.)

Future Outlook

As foundational models advance further:

Tools for integrating generative AI into operations will become essential.

Governance mechanisms will gain importance within enterprises.

High fixed costs and economies of scale will solidify hyperscaler/ big techs’ dominance in infrastructure and model layers.

For smaller companies:

Opportunities lie in practical applications built atop foundational LLMs rather than direct competition in resource-intensive development spaces.

Vertical expertise will be key—startups can succeed by capturing niches that big tech overlooks due to scale limitations.

In China's market specifically:

The “four tigers” have each navigated distinct paths in the evolving artificial intelligence landscape. Their journeys encompass initial strategies centered on large language models (LLMs), pivots toward consumer applications, and recent strategic shifts influenced by DeepSeek's R1 model release.

As I’ve written about in detail here, the multi-modal model and busy UI/UX preference adopted by Chinese big-tech AI apps have been a foreshadowing of what Doubao, Yuanbao, and so on have planned for the future. Consumer applications heavily rely on ad revenue and value-added services. It’s about increasing touchpoints, finding friction points, and prolonging engagement = the proven playbook that internet mobile apps made their money with, but that’s for the big tech with an existing massive user base to tap into.

Startups, on the other hand, should probably focus on creativity and vertical know-how to differentiate themselves. Their game must be in vertical expertise, and doing essentially big tech cannot be bothered to try to capture. The market won't be as big, but it will probably still be big enough.