"Four Tigers" Fate Divides, Big Tech Rejoices, Manus Moves to Singapore, and Investors Temper Optimism

Summer updates on China's AI startups and ecosystem

Hi all, welcome back to AI Proem. I have a few major collaborations in the pipeline that I’m excited to share with you all over the next few weeks. Also, I’m always happy to hear from readers, whether you're a startup founder, corporate professional, investor, academic, or industry practitioner.

Feel free to DM or reach out for a one-on-one chat.

A Few Updates on China AI Startups

Back in February, I wrote about China’s leading AI startups and how many of them are emerging from Hangzhou. So I was glad to see The New York Times pick up the thread this week with a story on Liangzhu, a Hangzhou suburb that’s become an unlikely hub for the country’s AI boom: NYT, July 6, 2025.

I still remember visiting Liangzhu a few years ago, during the COVID-19 pandemic (which is only about a 40-minute drive away from Alibaba’s main Xixi campus), when the indie art center had just opened and the area was still mostly empty, with streets and half-built apartment blocks. The speed of infrastructure buildout and how quickly talent concentrates around opportunity continue to amaze me in China.

Anyway, let’s take a look at how some of these startups are doing. Not all of the “tigers” or “dragons” of China’s LLM race are roaring ahead, so let’s see how a few of them are faring…

Baichuan LLM

In December 2024, Baichuan co-founder Hong Tao left the company citing personal reasons. And just today, news broke that another co-founder, Xie Jian, is also on his way out, although no details have been provided or reported by the media at this time.

For many, DeepSeek’s breakout moment rekindled global attention on China’s AI and internet sector. But for others, it marked the beginning of a fierce market competition they couldn’t keep up with. As I’ve written before, DeepSeek R1’s release forced China’s so-called “four tigers” to pivot one by one. And now, by the looks of it, for some, just pivoting wasn’t enough—this may be the beginning of the end for Baichuan as a serious contender in the LLM space.

MiniMax

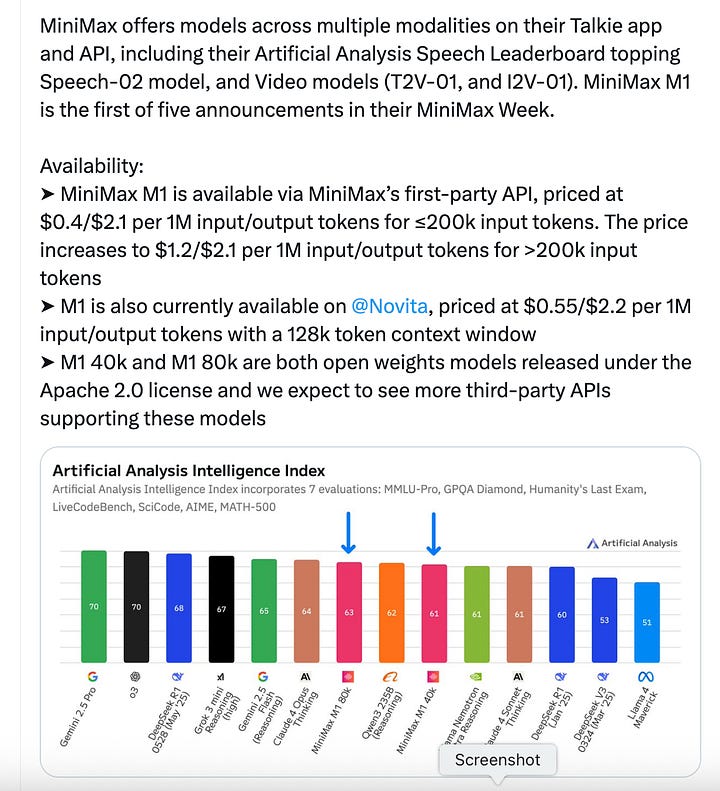

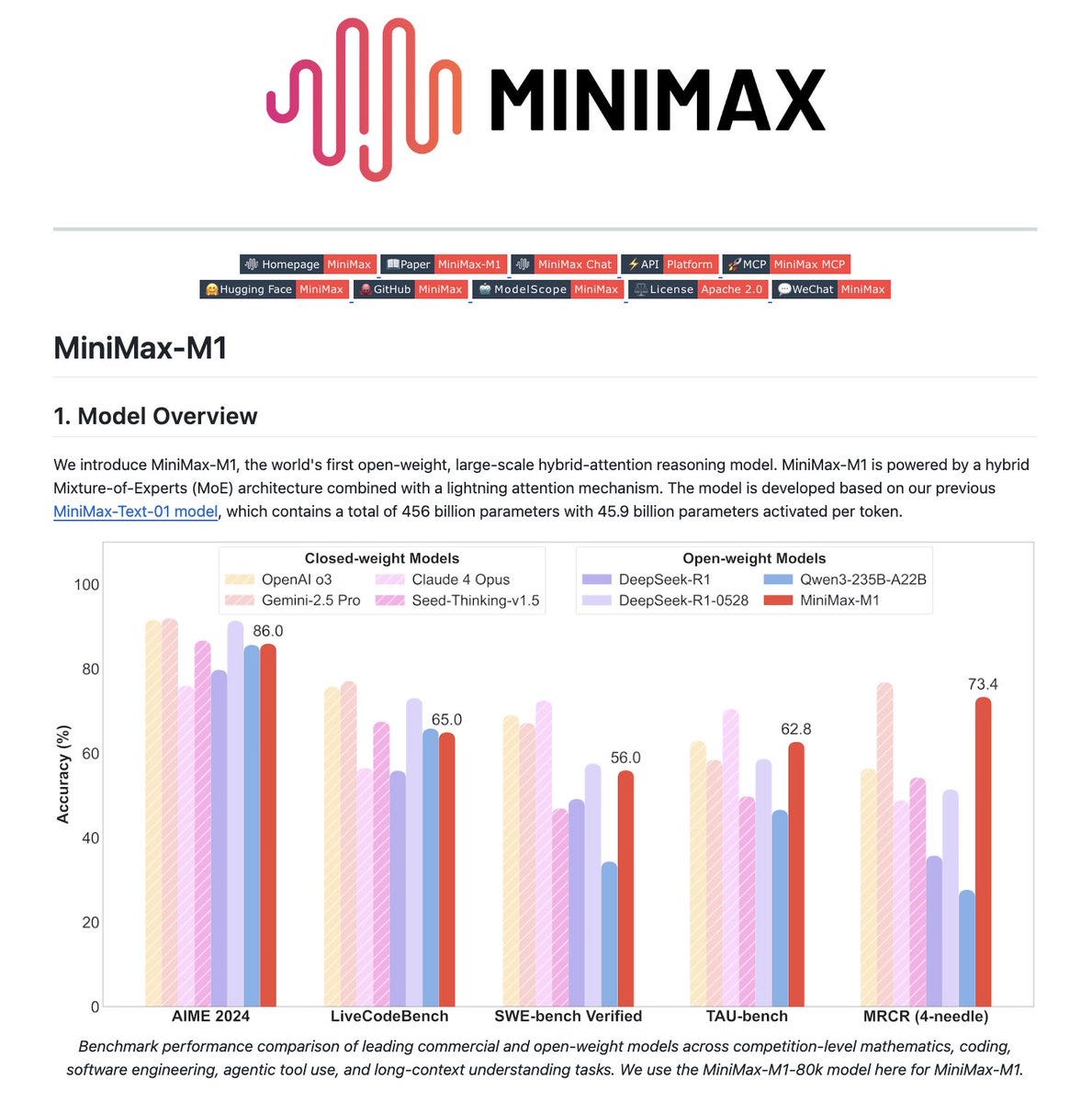

On June 18, MiniMax launched its first reasoning model, MiniMax M1, which is reportedly the most capable open-weight model in China (Github), following DeepSeek R1. It also boasts a context window of up to 1 million tokens.

See video on X of a person using MiniMax’s Agent to clone Netflix in one click.

Anyway, a few friends and I have tested its new Agent mode and found it surprisingly capable, with research and PowerPoint presentation quality equivalent to what you’d expect from a fresh college graduate. Its video capabilities are also drawing praise, with many comparing it to Midjourney in terms of visual quality.

Speaking of Midjourney, they also released a new batch of videos two weeks ago, which are also worth checking out.

According to media reports, MiniMax is reportedly preparing for a Hong Kong IPO as early as this year. Backed by Tencent and Alibaba, it’s the first of the top-tier Chinese LLM startups to move toward public markets.

MiniMax’s open-source model is also now ranking near the top of several public LLM benchmarks, adding further momentum.

See X: https://x.com/ArtificialAnlys/status/1935311012137402678

However, this raises a question: if model developers can create truly capable and user-friendly agents, do we still need standalone agent companies? Manus may say otherwise. Will research labs see agents as lightweight consumer-facing apps, or will vertically specialized agent startups still carve out defensible ground?

Zhipu LLM

In April, Zhipu also confirmed plans for an IPO, a move broadly welcomed by the Hong Kong capital market. Hong Kong’s IPO scene is showing renewed signs of life, with The Financial Times reporting that the city is on track for its most active listings year since 2021. According to HKEX, 208 companies applied for primary or secondary listings in the first half of 2025, the most vibrant it’s been in a while.

So hooray for us in HK! Friends in IBD are saying they haven't been this busy since pre-COVID times, as complaints of working late hours are resurfacing, but energy and optimism seem to have returned as well.

And companies along the AI and robotics value chain are the biggest beneficiaries. Case in point, a recent example is the warehouse robotics company Geek+ (02590.HK), which just successfully listed on HKEX yesterday, is making a splash across the city and media. See their IPO coverage here.

It’s not just capital confidence that’s returning. I recently spoke with a senior executive at Alibaba, who said the mood within China’s internet sector shifted dramatically after the DeepSeek moment. Before that, most AI research had been quietly ongoing within Big Tech, overshadowed by broader geopolitical headwinds and pessimism around the Chinese internet sector.

Suddenly, breakthroughs were gaining recognition, and the conversation shifted back to research and product, rather than just high-level geopolitical narratives. Media coverage changed 180.

Manus

Oh, the new AI darling. Many Chinese startups are trying to study the Manus playbook as it received a shocking Benchmark capital injection in April. The thing is, most companies wouldn’t be able to replicate Manus’ marketing and PR genius. First, what I heard is that the company heavily relied on one of its investors’ PR and marketing teams and took a non-conventional approach. It sold scarcity and exclusivity, making it intentionally difficult for traditional media journalists to obtain access to the trial codes, and shared its trial codes with various KOLs, which then flooded English and Chinese social media. It brought out the ultimate FOMO in everyone. Part of the hype was driven by its legitimate quality product, but the mystique definitely added to the interest.

Even when it started to actively PR, it did not push for a strong corporate branding message, unlike many of the big tech companies, which are all about their flywheel stories. It simply let KOLS rave about them, and then released a founder-direct message, which made it seem much more approachable and “cool.”

Amid the last four months of media frenzy, it’s actually been cutting headcount in its Chinese office and quietly (but not so quietly) hiring aggressively in Singapore. Many of their hires are from Singapore-based former ByteDance employees or other leading Chinese tech firms. While loudly and proudly rolling out a new campaign across the Singapore MRT (subway) system, as well as actively hosting offline developer and founder events.

ByteDance

Then we’ve seen ByteDance recently release a new suite of models that are increasingly seen as challengers to Kling’s dominance in text-to-image and video generation. You can find a detailed coverage of ByteDance’s AI strategy here.

In general, it seems like the big tech players are charging ahead with LLM development, consumer app user conversion, talent recruitment, and capital deployment. Since DeepSeek’s R1 launch, Chinese big tech is going 100000% ahead in this global AI competition.

Sentiment Regarding Chinese LLMs

Interestingly, during a webinar hosted by The Information in May, Jui Tan of Lanchi Ventures stated that app developers are now testing a wider range of LLMs—including many Chinese models —instead of sticking to a single one. A phenomenon we’ve also heard from Altos Ventures in Korea, regarding startups being model-agnostic in building AI apps.

Additionally, I’ve heard from a few journalists in Silicon Valley that some U.S.-based startups are quietly experimenting with DeepSeek and other Chinese models. The issue isn’t technical performance—it’s PR optics. Like what the Alibaba executive said, business is actually doing well, and extreme negativity has dissipated.

But in a pragmatic sense, most non-Chinese application companies are still trying to steer clear of being seen as using Chinese LLMs, which doesn’t mean they’re not using them. For Chinese companies going global, some are still adopting the “China shed strategy” by setting up shop in locations like Singapore, which, frankly, I’ve had many inbound inquiries on how to do better.

Final Food 4 Thought: Are We in an AI Bubble?

Lastly, a discussion around whether we’re hitting an AI bubble has been widely discussed within the investment space in China. While most still believe that infrastructure needs to be continuously built out to meet the demands of future AI compute use, and many are still holding onto the idea that vertical use case is the future of AI SaaS.

Some have expressed a bit of skepticism and offered this framework (see the framework provided by 阿尔法工场, a WeChat blog backed by A-share focused hedge fund Keywise) that has caught my attention:

「第一波:技术突破」 - DeepSeek证明了技术可行性,Manus展示了产品可能性

[First Wave: Technological Breakthrough] DeepSeek proved the tech is viable; Manus showed what the product could look like.

「第二波:资本狂欢」 - 概念股涨停,融资估值飙升

[Second Wave: Capital Euphoria] ADRs soared, funding rounds went wild.

「第三波:现实打击」 - 商业化困难,成本压力巨大

[Third Wave: Reality Bites] Commercialization remains challenging, and cost pressure increases

「第四波:市场洗牌」 - 只有真正解决问题的产品能活下来

[Fourth Wave: Market Shakeout] Only products that solve real problems will survive.

Questions for you all: Where are we now, considering the framework above? A recent conversation with a UK-based industry leader made me reflect on three broader questions:

Does China’s AI sector take a more pragmatic, product-driven approach, and is that a strength or a limitation?

Does Chinese capital only follow proof of concept, whereas Silicon Valley is more willing to back bold ideas and founding teams?

Are industrial policies in China truly “top-down” drivers of innovation, or do they follow innovation once its usefulness has been proven?

Would love to hear your thoughts!

Stay tuned. A deep dive into RedNote and its AI strategy is underway, in collaboration with China consumer expert of Following the Yuan.

1. I don’t think China’s approach is much different from the US one in terms of the product. The US market is flooded with AI agents nowadays, the product adoption is still decent, more innB2C, but in B2B too. What I think is unique for China is that many former LLM developers started pivoting towards applications, while in the US you have OpenAI, Anthropic and Grok doing both.

2. I feel it’s true, considering that most of the Chinese LPs now mandate the portfolio companies of their GPs to generate revenue as soon as possible. It forces Chinese VCs to be more risk-averse.

3. It’s like a pendulum, but usually innovation comes first, as it was the case with most other industries.