DeepSeek's Ascent Reshapes China's Burgeoning AI App Landscape

Beyond the hype, what has DeepSeek really helped achieve over the last few months?

*figures from Questmobile cited from Citi’s Implications From Pre and Post DeepSeek Insights and Analysis On China AI Apps Report published in March 2025.

China’s artificial intelligence (AI) ecosystem is undergoing a seismic transformation catalyzed by the rapid adoption of DeepSeek’s groundbreaking R1 model. The startup’s meteoric rise is not only reshaping the AI application market but also redefining the global narrative on AI innovation and accessibility. With a focus on cost efficiency, open-source frameworks, and technological breakthroughs, DeepSeek has emerged as a key driver of growth, innovation, and competition in China’s burgeoning AI sector.

DeepSeek’s open-source approach has been pivotal in democratizing access to advanced AI technologies. By partially releasing its model architecture and parameters, DeepSeek has fostered collaboration among developers and enterprises, enabling them to customize and enhance its capabilities, as CNBC reported with a long, extensive list of open-source adoptions across the sector.

The open-source movement initiated by DeepSeek has prompted other major Chinese firms, including Baidu, to follow suit. Baidu recently launched its ERNIE X1 and ERNIE 4.5 models with open-source frameworks, signaling a broader shift in China’s AI industry toward accessibility and innovation.

For many, the choice of open-source is not just a business decision but a bigger movement in China.

Vital Timing of DeepSeek

DeepSeek’s emergence comes at a critical juncture for China’s economy. After facing a domestic slowdown in areas such as real estate downturns and trade tensions with the U.S., Beijing has embraced AI as a strategic growth driver. Goldman Sachs projects that AI adoption led by DeepSeek could boost China’s GDP by 20 to 30 basis points by 2030 through enhanced productivity and automation. The government has also ramped up investments in AI infrastructure, with companies like Alibaba forecasting significant capital expenditures to advance frontier models.

DeepSeek’s breakthrough has injected confidence back into the economy and society at large. Young entrepreneurs are bright-eyed, and investors are eager to find the next big deal or trend. As Bloomberg puts it, it’s “fired up a long-dormant Chinese tech industry.” (By the way, this is a really good long read; I highly recommend it.)

Artificial Intelligence Generated Content

As DeepSeek's swift adoption has spurred unprecedented growth and shifted user demographics, AI applications are taking off at rocket speed across the country, according to a recent analysis by Questmobile (China’s leading mobile app service provider).

The rise of DeepSeek, along with other key players like ByteDance’s Doubao, Tencent’s Yuanbao, Moonshot AI’s Kimi, and Baidu’s Ernie, has propelled the aggregate monthly active users (MAU) for AIGC (Artificial Intelligence Generated Content) apps to a staggering 248 million in February 2025. This growth trajectory is remarkable, with AIGC apps achieving a 20% internet user penetration rate in just 23 months, outpacing even the rapid growth of short video apps, which took 30 months, according to Citi Research.

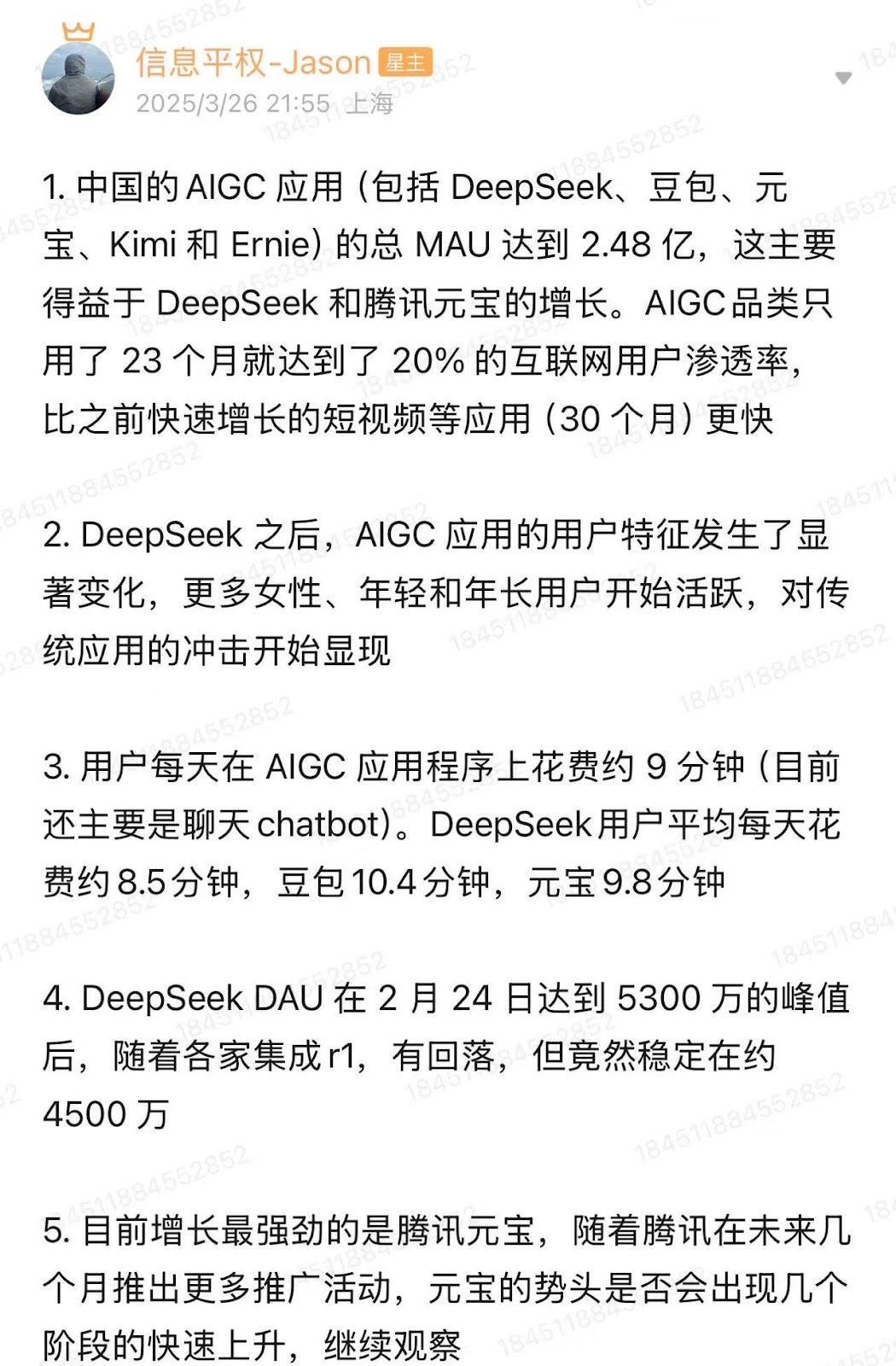

Zooming in on DeepSeek’s achievements over the last few months. It achieved the fastest daily active user (DAU) growth in the history of the Chinese internet, reaching 50 million DAU in a mere 42 days. This is a stark contrast to established giants like Douyin (371 days) and PDD (741 days) in reaching the same milestone. While DeepSeek's DAU has since stabilized at around 45 million after peaking at 53 million in February 2025, its initial surge has left an indelible mark, according to industry blog Democratizing Information 信息平权-Jason . This stabilization occurred as more Large Language Models (LLMs) integrated DeepSeek and launched their own reasoning models.

The dramatic increase in overall user numbers clearly illustrates the rapid expansion of the AIGC app market. In February 2025, the total MAU for AIGC apps reached 245 million, a significant jump from 148 million in January 2025, 37 million in February 2024, and just 8 million in May 2023 in China, based on Questmobile’s figures. This explosive growth reflects a burgeoning appetite for AI-powered tools among Chinese internet users. Correspondingly, aggregate time spent on AIGC apps reached 464 million hours in February 2025, an eightfold increase year-over-year and a 66% month-over-month rise. On average, users spend approximately ~9 minutes per day engaging with major chatbots. Specifically, DeepSeek users spend around ~8.5 minutes daily, compared to ~10.4 minutes for Doubao, ~9.8 minutes for Yuanbao, and ~6.6 minutes for Ernie.

AI for All: Adoption Through the Roof

Beyond sheer numbers, DeepSeek's emergence has also triggered a notable shift in the demographic profile of AIGC app users.

Previously, AI apps attracted a larger proportion of male users. However, post-DeepSeek, there has been an increase in the activity of female, younger, and older users. China seems to be taking on a “全民AI” (AI for All) approach. From grandma/grandpas in their 80s to primary school pupils, everyone’s eagerly downloading AI apps onto their smartphones.

In February 2025, out of the 245 million AIGC app MAU, 61% (149 million) were male, and 39% (96 million) were female, representing substantial growth of 89% and 128%, respectively, since December 2024.

Furthermore, when total MAU grew by 102% from December to February, the age group below 30 grew by 108%, while the age group above 40 saw an even more significant increase of 238%, compared to a more modest 54% growth in the 30-40 age bracket.

By February 2025, 41% (100 million) of AIGC users were aged 30 or below, 35% (85 million) were between 30 and 40, and 24% (59 million) were above 40. This broadening user base suggests a wider adoption and integration of AI tools into the daily lives of diverse segments of the Chinese population.

While DeepSeek's initial momentum was strong, the Citi report notes that DeepSeek’s download volume has started to decline as more LLMs incorporate its technology and release their own models. Despite this, DeepSeek's DAU has remained resilient. The report also highlights the significant growth of Tencent's Yuanbao since early February 2025, suggesting a dynamic and competitive landscape where different players are vying for user engagement. It remains to be seen whether Yuanbao can sustain this momentum through increased promotional efforts.

Empowering the Whole Value Chain

Many have expected the parade of open-source models ignited by DeepSeek’s initiative to spill over into adjacent fields, from smart EVs to humanoid robotics and beyond. Which we’ve started to see already…(Bear with me. This is the topic for a piece that’s been long in the works - China’s strength in Physical AI, powered by the prioritization of the “real economy.”)

According to Bloomberg’s interview with Balaji Srinivasan, tech investor and former general partner with Andreessen Horowitz, he said that with China’s strength in hardware, the cheaper and more accessible the AI models, the more the demand for devices powered by AI.

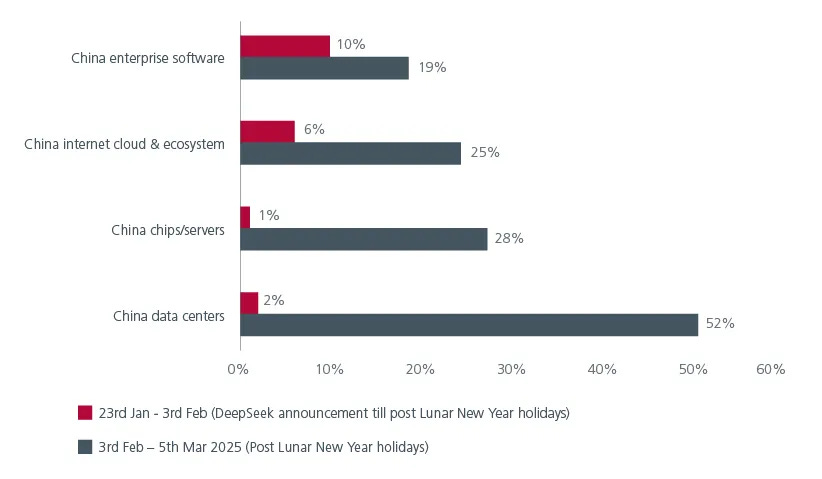

In fact, its impact has truly been seismic. There has been a rally across all the industries AI touches in China- across the supply chain.

And a 1 trillion dollar wipeout in the U.S. markets. (see the Fortune article here, a very nuanced piece about DeepSeek’s global industry implication, and they cited me ;p)

A Catalyst for Transformation

By prioritizing cost efficiency, open collaboration, and broad accessibility, DeepSeek has set new benchmarks for innovation while challenging American dominance in the field.

DeepSeek's rapid ascent has acted as a catalyst for the explosive growth and evolving user demographics within China's AI application market. While the competitive landscape is heating up, DeepSeek's initial impact demonstrates the significant potential and transformative power of AI in engaging a broad spectrum of Chinese internet users (as I said, consumer apps can scale so fast in China).

As China embraces this transformative wave of AI applications, the implications extend far beyond its borders—reshaping global perceptions of the future of AI.

The interesting thing is that this has driven up OpenAI's MAU at the same time.

Global democratisation of AI